Gravity (GRVY) - Pre-Q2 earnings update. Firing on all cylinders.

Time to take a holistic view at Gravity (GRVY)'s performance, from business operations to stock valuation, since we last reviewed them in Nov 2023.

Gravity (Nasdaq:GRVY) will be releasing their Q2 earnings this Friday Aug 9 (pre-market in the US). We have been covering GRVY (Datasheet) again since October 2022 in our initiation article, when we loaded the truck at $46.2 following a certain Origin release in Taiwan that blew their revenue out of the water.

Previous Gravity updates/articles:

Executive Summary

Since initiating Gravity in Oct 2022, the stock is up 63%. That’s strong, but a mere α of 5.8% against the Nasdaq.

2023 was a huge year, with Ragnarok Origin in south east Asia blowing out all expectations and helping drive a +56% revenue and +59% in profits YoY.

After 8 years of growth at a CAGR of 39%, the company remains vastly undervalued at current P/E of 5.5, given how profitable and cash-rich it is

2024 is up to a stronger start than we anticipated, with multiple successful releases on mobile, and a China expansion on PC and mobile.

Q2 2024 could be the best quarter in revenue and certainly in profits since Q2 2023. It certainly was the most exciting!

An all-mighty 2023 year to compare against, the end of cycle of Ragnarok Origin and a lack of shareholder return will keep some investors at bay, even if 2024 is shaping like a strong year.

Updates on First Half of 2024

Plenty o’ successful releases!

The 2024 pipeline has beaten all expectations so far. Here’s what happened:

January 23rd: Idle Adventure (Thailand)

#1 grossing game upon release. Thailand loves Ragnarok, so it’s almost expected. The game has barely been updated since launch unfortunately, but the potential is clear. It will get rolled out globally in H2.February 26th: Ragnarok Origin (Americas release)

Helped revive Ragnarok’s IP flames in the americas, and as expected very successful in Brazil, where it stayed a top 15 earner for a while.March 27th Ragnarok Origin (China release)

Published by Ruyi, ROO CN was #1 in download at launch in this juggernaut of a market, and was in top 15 grossing at its peak. Strong given it’s the first release of a Ragnarok games in probably 7 years in China. Likely helped in Q1 profitability surge, even if it was out only for 3 days.June 5th: Ragnarok Battle of the Novice Hearts (Hong Kong, Taiwan)

Biggest release for the end of Q2, Ragnarok Novice Hearts was released in TW & HK and performed superbly, hitting the #1 revenue spot there. 2 months in, it’s still in the top 20-30, showing signs of long tail revenue.June 27th: Ragnarok Rebirth (South East Asia)

Brand new game released in SEA. After 1,5 months it sits in the top 50 in most countries. Decent, but not as strong as Novice Hearts.

June 28th: Ragnarok Online (PC - China)

Old school Ragnarok Online revival on PC hit China and they seem to love it. It's hard to get numbers on this, being China. But the game has been spotted for a long time in the top 15 hot games on WeGame, the local Steam.

That’s only Ragnarok games, but let’s focus on them given the indie games publishing has not shown signs of traction yet. It’s been a lot, and they have all had a certain degree of success, which could not have been expected.

Graph is not for the faint of heart, but directionally provide a sense of Gravity’s mobile gaming revenue per game.

Conclusion for H1: Gravity has drilled definite holes in the “But there’s nothing after Origin and Next Gen” and “But people will get tired of the Ragnarok franchise” theories. They have shown that they can keep launching average quality games with the Ragnarok stamp on it and monetize them strongly. That’s what they do, and it works.

What does this mean for Q2?

When looking at Q2, what is driving revenue?

Legacies: Ragnarok Origin worldwide is still breathing well and providing long-tail revenue, whilst Next-Gen and Eternal Love seem to have reached cruising speed

China release of Ragnarok Origin end of Q1 means the core of the revenue for this game will be in Q2. Ragnarok Online on PC was also released in China, but had only 2-3 days in Q2.

Novice Hearts, which had 25 days of running in Taiwan and Hong Kong before end of quarter and is currently the #1 revenue game for Gravity altogether.

This is our estimates of Q2-2024 share of revenue per game (mobile only!)

Where does that lead us ? There is a LOT uncertainty regarding the Chinese agreement, but if we were to guess (and it’s what it is, a guess), we would go for:

$120-$140 millions in revenue

$22-$30 millions in net profit

This would bring Q2’2024 to one of their strongest quarter ever, and could be well ahead of investors’ expectations.

Going into Q3/H2

Whilst H1 was quite exhilarating with the sheer amount (and success) of Ragnarok games, Gravity has a few tricks up their sleeves for H2.

First, there’s Ragnarok Online China, Rebirth SEA and Battle of Novice Hearts Taiwan which will be beating the drums from the start of Q3. Novice Hearts is currently the top grossing game for Gravity in Q3, above Origin.

Then there’s the pipeline:

Ragnarok franchise, in order of how excited we are about them:

Next Generation (China + Japan releases, after massive SEA successes)

Idle Adventure (Global release after TH success)

New games:

Ragnarok: Dawn (not announced in Q1 presentation, but they announced a deal with TeamTop recently), planned for China

Ragnarok in Wonderland

Ragnarok V: Returns

Ragnarok Monster’s Marble

Ragnarok Monster World

Non-Ragnarok:

NBA Rise: After a failed launch in the past - let’s hope they’ve gotten the game to a new level for a re-launch in Japan

Mirren: Millenium Tour (Indie turn strategy RPG)

KAMiBAKO (Indie RPG - console/PC)

Tokyo Psychodemic (console/PC, global after Japan release)

Of course, pipeline may evolve, but Next Gen in China and Japan is enough to drive substantial revenue, should the game be as successful as it was in Taiwan.

Valuation - Will you ever rise?

At current stock value of $71.12, Gravity is worth $495M, with over $350M in cash and practically no debt, giving the company an EV of approx. $145M.

Q1 came in at approx. $88M revenue and $19.7M in net profit, a 22% net margin and an EPS of $2.85.. stellar metrics. Yet investors give GRVY a sub 6 PE, and an EV/Sales of 0.3x.

That PE has been in the same region since 2022-Q4 (and the Origin Taiwan release which led us to invest)£:

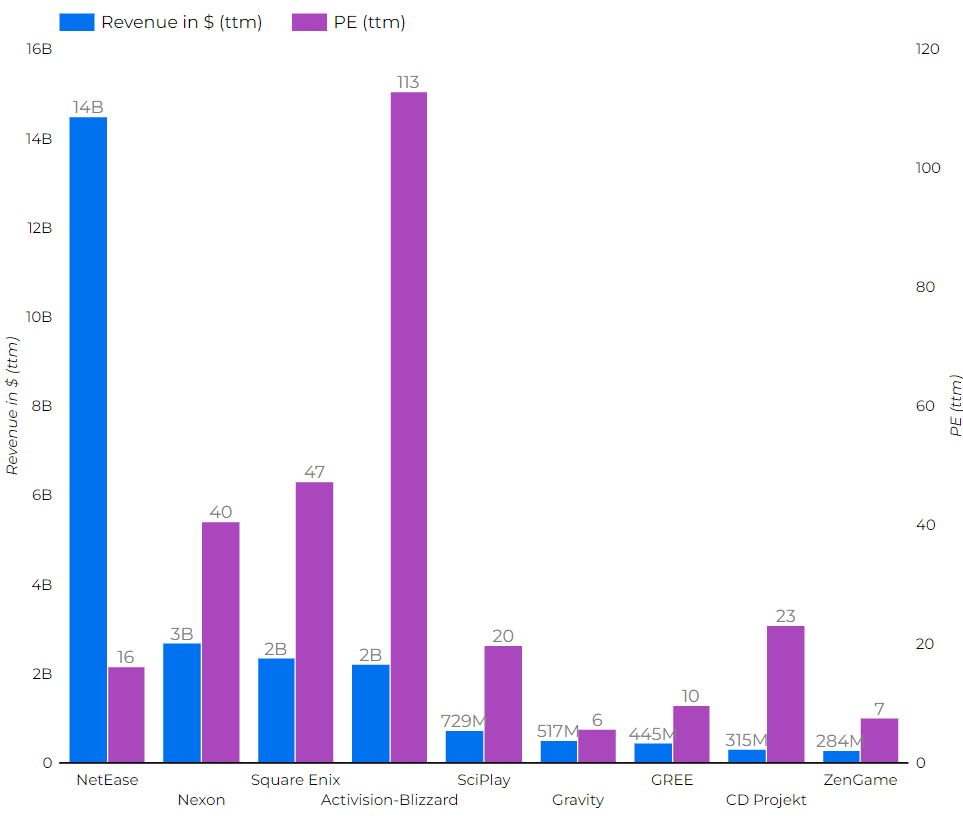

But not all mobile gaming players receive such cold welcome from investors. Here are a few of Gravity’s competitors’, ordered by revenue (ttm) and with their respective PE on the right-vertical axis. A PE of 20 would not turn heads for Gravity, given how profitable they are. That’s 4x today’s value.

A quick glimpse at the Revenue vs Net Profit vs Market Cap over the last 4 years, we note a few things:

2020 hike was fueled by pandemic and Origin Korea being their strongest hit in a long time. Then the post-pandemic crash hit, and investors have not yet realigned. Q1 2024 had higher net profits than Q3 2020, yet the stock rose to over 4x current price back then.

As Origin’s getting towards the end of its cycle (still strong, but no more release), growth has stalled… at least until this coming Q2.

Investors do react, to better quarters in a row and new game successes but gain-taking ensues rapidly.

Also, if you have to factor in market growth, the tide that lifts all boats. If you consider the 5.8% α against the Nasdaq since Q3 2022, it’s clear investors are not rewarding Gravity fairly for the recent growth, since it’s done much better as a business than you average NASDAQ company.

But why? There are a few theories out there as to why this is looking like a value trap:

Gungho 59% ownership - which makes a buyout unlikely. They’ve owned it for close to 2 decades now, through thick and thin. The subsidiary has outgrown the mother company in the past 3 years, they won’t sell.

Cash allocation: No strategic acquisition, no return to shareholders via dividends or shares buyback programs.

→ Tend to agree here, however they are investing in publishing indie games on multiple platforms, as well as in growing their franchise with new games and large marketing operations, which have been quite successful.It’s a Korean company traded on the NASDAQ but their games are not popular in the western world. Investors there do not grasp the power of the Ragnarok franchise.

Lack of trust in game pipeline

→ This seems baseless. Numbers are like Shakira’s hips, they don’t lie. New games are coming out and doing just fine, and that’s been the case for 8 years in a row now.

Conclusion

Strengthening franchise, a hit-filled H1 2024, expansion into the #1 mobile gaming market in the world (China).. Gravity’s core business has never looked sturdier

Gravity remains our favorite risk/reward on the basis of their ultra low PE, strong earnings and growth prospects. You are currently paying less than 2x EBIT for the stock.

With a strong cash chest and against the backdrop of an industry filled with bankruptcy and layoffs in the past year, Gravity is ideally positioned to acquire talented studios and IPs at a discount, to support their growth.

Disclaimer

The information on this website and blog is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.

Earnings are out for Gravity, and we're quite far off. In fact, it's like Ragnarok Origin China, the #1 story of this Q2., is absent from those numbers.

Surprisingly, Origin China is not mentioned all in their 6-K. It's certainly not an omission, given how they always list which game/release drove revenues and expenses up/down, every quarter.

It could well be that Q2 does not account for any revenue or profit for Origin, which is the only way we can explain those numbers, to be honest.

Still, a profitable quarter for an undervalued company, sitting on a growing pile of cash.

Here is a link to their earnings presentation: https://img.gravity.co.kr/GravityUpload/0000/2024/08/09/Gravity%20IR%20Presentation_2024_2Q_EN.pdf

Here is their SEC disclosure document 6-K: https://www.sec.gov/Archives/edgar/data/1313310/000162828024036323/a6-k_gravityxsecondquarter.htm

Any theories on why Origin China, is left out of the story? I'll let you know should IR reply.

I was wrong about my theory...