Gravity - Q3 earnings update.. Strong but.. Yawn?

This is a quick update on Gravity (NASDAQ: GRVY) following their Q3 2023 earnings release

For reference, we have been covering GRVY (Datasheet) again since October 2022 in our initiation article, when we loaded the truck at $46.2 back then

Previous Gravity updates/articles:

Executive Summary

Our pre-earnings estimates turned out to be quite accurate:

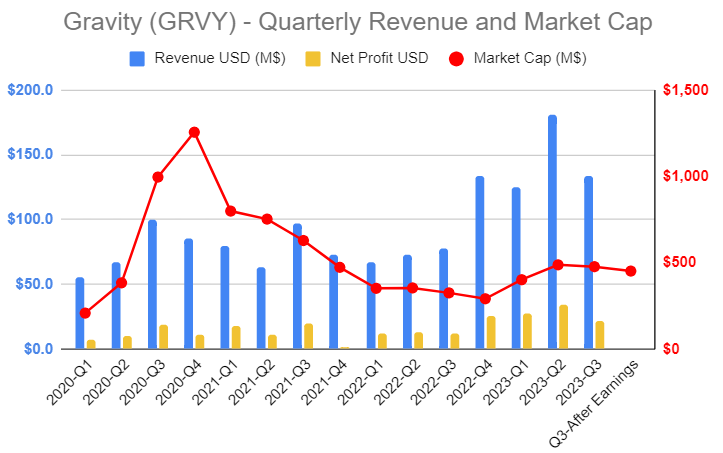

Q3 revenues came in at KRW 176,145 millions or ~US133M, a 26% decrease QoQ but a 76% increase YoY.

Net income hit ~US$22M, a 35% decrease QoQ and 80% increase YoY

Market reaction: GRVY landed at 65.00 after today's earnings movements (+5%)

With US$335M in cash, Gravity is worth US$121M (EV) at market cap of US$451M, trading at TTM values of 0.21x Net Sales and a P/E of 4.2.

Pipeline & announcements: ROO China confirmed for January’24, ROO Latam delayed to Q1, Begins (x-platform MMORPG) confirmed for December in Korea

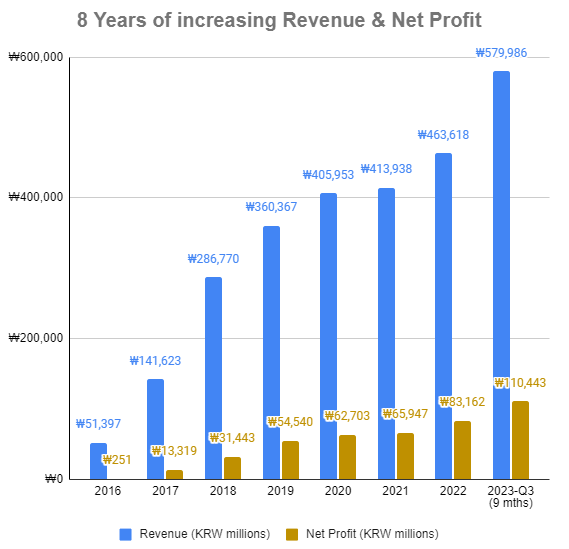

Only 9 months into 2023, Gravity’s now confirmed its 8th year of growth in a row (see graph below), because it already exploded 2022, see below!

Updates

Q3 Top line and bottom line

At US$133 millions revenue Q3 2023 is the 2nd best in Gravity’s history on top-line, logically beaten by Q2 which had the phenomenal Ragnarok Origin SEA (“Global”) release. With US$22 millions in profits, net profit margin was a bit lower at 16.4%, with higher overall cost of revenue, SG&A and income taxes than we expected.

Stock - Investor reaction & current valuation

After stalling most of the morning, the stock went up 5% on a… lower than average volume, bringing the market cap to US$450M. So… good news? Maybe, at least nobody’s selling. Given the stock has not moved up since the absolute monster Q2, it is fair to say there isn’t a lot of interest nor visibility in Gravity.

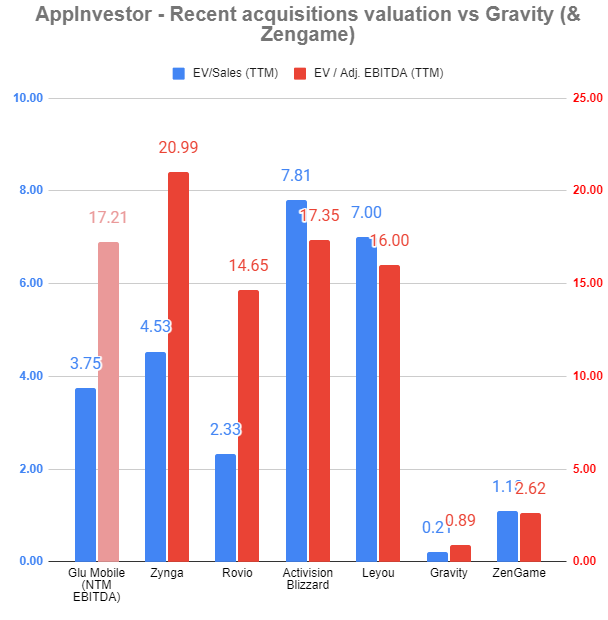

After todays’ stock movements at $65, Gravity trades at 0.21x Net Sales and 0.84x EBITDA. To put that into perspective, these metrics were 5x higher in 2022. 8 years of growth and investors are…bored ?

And because there is never enough perspective, the below graph compares Gravity with recent acquisitions in the space.. Quite telling!

Those Q3 results are very encouraging for Q4, as they show the ability of Gravity to maintain live operations on their successful games over time.

Going into Q4

What about new games impacting Q4? Here’s a recap:

Ragnarok Landverse (see last article for an update on how it’s doing) was released at the very end of Q3. It’s doing better than we expected for being a copy-cat Ragnarok Online PC game with NFT

Ragnarok 20 Heroes launched in South Korea and we’ve already forgotten about it

Ragnarok Begins is meant to be released in South Korea in Q4. Begins is a side-scrolling MMORPG in the works for some time now. It’s probably the highest potential for this Q4

Conclusion

Gravity butchered yet another opportunity to get investors onboard, by not doing anything about their growing cash pile nor mentioning any plan for it, and sticking to the same boring pre-formatted sentences we’re used to in every earnings press releases.

Q4 is set to be pretty uneventful with no major releases, and the usual suspects driving the bulk of the revenue (Eternal Love, Next Gen & Origin). Best investors can hope for is a successful Begins release and who knows, a chinese license for Next-Gen? They have a publisher for it now, after all.

Disclaimer

The information on this website and blog is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.