This isn’t just gravy - Gravity is back on our portfolio

This isn’t just gravy - Gravity is back on our portfolio

Executive Summary

Gravity Co., Ltd. (GRVY) is a Nasdaq-listed Korean video game company that was founded in 2000

Known for "Ragnarok" its very popular IP/franchise in SEA, Gravity have successfully been shifting towards mobile gaming the last 7 years

Stock has taken an unfair beating and the company valuation is 2-3x below other similar companies, and is closing in on 0$ Enterprise Value

There is limited downside risk - our main concerns are with Gungho ownership and lack of buybacks

The very successful release of Ragnarok: Origin in Hong Kong and Taiwan, combined with the upcoming release of Ragnarok: Next-Gen are serious catalysts for next quarterly release

It comes back to our Active Picks list as of October 13th 2022

Ragnarok Origin - still leading the charge

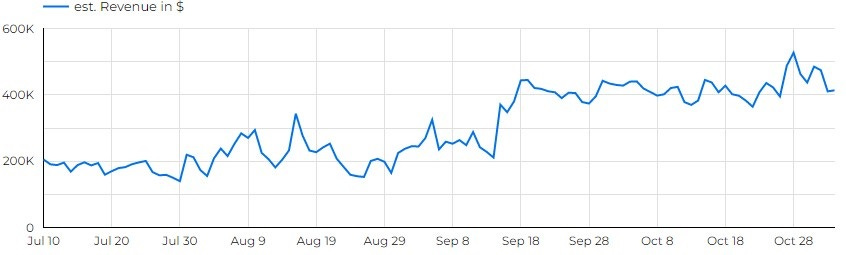

Over 2 years after its initial release in South Korea, Ragnarok:Origin is being released in SEA countries to replace Ragnarok: Next Generation as the flagship Ragnarok MMO. And it’s working very well. In fact, Origin went straight up #1 rank and is taking Taiwan and Hong Kong by storm, two small but large revenue countries for the mobile app market. Given Origin is cross platform, it has both mobile and PC revenue tied to it (which we do not see in our charts below).

Gravity's strategy is simple: they release their games market after market (sometimes by cluster). Origin is new in south east asia, but has already been released in Korea, Japan and North America. It is planned to be released in 2023 in the rest of the world.

Financials

We estimate that with only two months in this quarter, Origin could increase US$30 millions revenues per quarter in the next two (Q42022, Q12023) assuming a slow decline as time goes like with any game.

At US$42.60 a share, Gravity’s market cap is just below the US$300 millions. In FY2021, they generated.. US$300 millions in revenue and US$40 millions in profits, giving it a sub-8 PE, for a company increasing their revenue every year in 7 years.

We think the numbers simply don’t add up, and with Origin being a major hit in Taiwan and Hong Kong, we expect Q4 to be one of their strongest quarter ever and FY2022 to be another year of growth for Gravity. This should flock a few people back to this stock, which has been rather depressed and not reacted much to those events.

Due to the low float (insider ownership is high), Gravity can move up (and down) pretty fast. We consider it an ignored and undiscovered stock by most analyst.

The contra-arguments: cash hoarding with Gungho as a major shareholder

When looking at a company, you want to weight both side of the balance. One of our key concern, not from an operational standpoint but from a stock appreciation standpoint, is that Gungho (3765.T) owns 59% of GRVY shares. Gungho itself is not much bigger than Gravity and they do not seem to be putting any effort into increase Gravity stock value. There has been no buy-backs or dividend on the side of Gravity for as long as one can remember. Gravity’s press releases are the most boring ones you’ll ever read, they’re basically growing and hoarding cash, and never really sharing any exciting plan on what they will do with that cash. It’s a safe company, but this limits investors' belief that it can skyrocket, and thus, limits our upside potential on the stock.

Some people are concerned about their dependence on the Ragnarok franchise, calling Gravity a one-trick pony. We disagree, a franchise is not the same as a game. If anything, they have shown that they can grow that franchise very well and leverage it. Still, in 2022 they have started diversifying more by striking publishing agreements on non-Ragnarok themed games. We see it as a non-problem for now.

Conclusion

Gravity is executing on their strategy. It’s a fairly low-risk one (even though they seem to be headed towards more self-developed & published games in the recent years), but it works. Revenues are growing at a steady pace, FY 2022 is having a strong finish, and the company value is ridiculously low, inching closer and closer to a net 0 value play (when your cash equal to your market cap, your Enterprise Value (EV) becomes $0).

On top of that, after top-tier releases in all SEA, Ragnarok: Next Generation is headed to Korea somewhere in Q1 2023, their strongest market. Should that one be a success, with Origin wreaking havoc in TW and HK, FY2023 is looking like the best start to a fiscal year they have ever had.

The question really remains: what are they going to do with all that cash? We would like to see buybacks, or investment in growth, through acquisition for example.

It joins our Active Picks list as of Nov 3rd 2022 and we will update should we see any major changes in our research. GLTA!