[Weekly - June 15th 2024 - Gravity's (GRVY) and CMGE (0302.HK) at the top

Let's look at the implications of Gravity's new Ragnarok hit game.

As you may know, I maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and I estimate their mobile revenue on a daily basis using proprietary tools.

Every Monday onwards, I will be sharing a screenshot of my “Mobile trends for public companies” dashboard as well as a commentary.

This is one of a series of dashboard used for triage and identifying uptrend or downtrend in weekly revenue, before deep diving into opportunities.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Winners of this week

Gravity (GRVY) is unsurprisingly top of list this week following the release of RO仙境傳說:初心之戰, (translated to Ragnarok, Battle of the Novices) in H and TW, and it’s doing superbly well. More on this below.

After a week and a half, it’s ranked #7 and #2 on App store and Play store in Taiwan (largest market) respectively in terms of grossing

Market reacted swiftly to the news but we have seen some profit taking, with the stock moving from $75 to $88 then back to $83

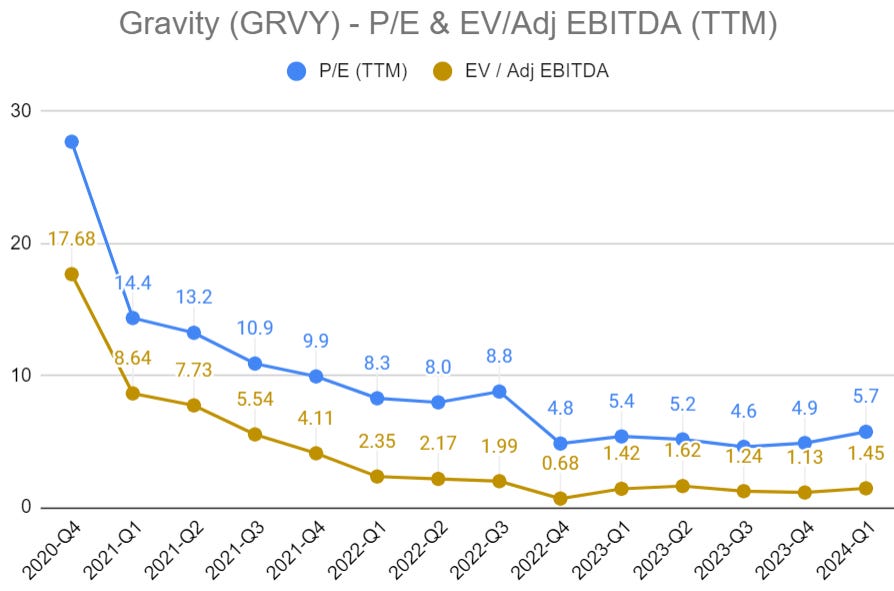

Gravity’s TTM PE ratio is 5.7 and this successful release brings high expectations on Q2, between ROO China and this new Ragnarok title.

We’ve had shares of GRVY since October 2022, so we haven’t bought on this unexpected success, but that’s only for diversification purposes.

CMGE (China Mobile Games and Entertainment (0302.HK) tops the worldwide chart with a massive 366% est. revenue increase.

This is due to the release of 斗破苍穹:巅峰对决 (translated to Battle Through the Heavens: Peak Showdown), which hits the top 50 grossing in China on App store.

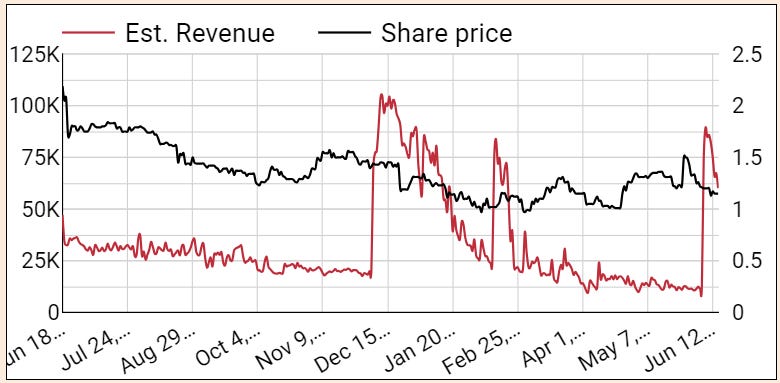

Revenue vs share price chart (last 52 weeks) shows CMGE’s 'revenue have in the past been to these levels, albeit not for very long

Even if you triple these figures to account for the Android phone stores (Google Play doesn’t exist in China), it still only accounts for a fraction of CMGE’s total revenue, which may be outside of mobile.

All in all, worth keeping on watch list, but we didn’t dig deeper.

Bilibili (BILI) is also up significantly in revenue thanks to the release of 三国:谋定天下 (translated to Three Kingdoms: Conquering the World), which hit top 5 in China app store.

BILI is a $3B revenue, $5B market cap company, and mobile gaming is just a fraction of their revenue.

We roughly estimate that this new game is bringing in around $3M/day at those ranks (incl. Android), so it’s not unsignificant. However mobile gaming is only a portion of their revenue.

BILI enters watch list, but we don’t expect this game to stay in the top for very long. Few games do in China.

Losers of this week

For 3 weeks in a row, Moatable (MTBLY) and iHuman (IH) are topping the downtrend board. Our past 2 weeks report mention why, and we have not dug deeper.

Share your knowledge if you’re an investor in one of these 2!

Company Highlight: Gravity

The new Ragnarok game by GRVY is really the highlight in terms of actionable trades in the mobile space in our perspective these last few weeks, for 2 reasons:

Taiwan is a top 5 worldwide market in terms of mobile revenue. In October 2022, we bought Gravity at half today’s price because of Ragnarok Origin’s successes in Taiwan. Their revenue soared.

It’s “yet another” Ragnarok hit, after Next Gen and Origin (in this order) in this country. How many hits in a row before investors stop believing in the one-hit wonder theory?

Move over, Ragnarok Origin! Last week, Ragnarok, Battle of the Novices drove around 46% of Gravity’s mobile revenue based on our estimates. That’s the first time since October 2022 that Origin isn’t #1.

Gravity 101:

Gravity is only valued at $580M, and that’s with over $350M in cash and TTM revenue of $492 as of Q1 2024. That’s after 8 years of growth on revenue and profit alike.

So Gravity is valued as if it’s about to fail with

PE of 5.7, vastly below its competitors

EV/EBITDA < 1.5 (meaning their enterprise value will be 0$ in 18 months)

EV/Sales is 0.3, meaning their revenue is 3x their current enterprise value

2024 is shaping to be another strong year. Maybe not as strong as 2023 (which saw Gravity’s revenue soar 56% YoY!), but easily +30% vs 2022.

With 3 new game licenses in China (#1 mobile revenue market in the world), a seemingly unending pipeline of new games, there is no shortage of potential catalysts for growth in the near future.

Beware of Q2 YoY revenue numbers. When Gravity announces Q2, they will use YoY as a comparison. Q2 2023 was their strongest quarter ever (by a 40% margin) with the Origin SEA release. You will see negative YoY revenue that may scare you. Profits, however, will certainly be closer to last year.

If you want to read more about Gravity:

Gravity initiation article from October 2022

All Gravity articles

Conclusion

No action for us this week. We would have opened a GRVY position, but we have plenty there already.

That’s it - as always if you have comments or questions, they are most welcome! Have a strong week.

why is the sales contribution of 仙境传说:爱如初见 so small (Looks like c.5%), while its grossing has been ranked high?

https://app.sensortower.com/overview/6468898329?country=CN&tab=category_rankings

Even compared to RO仙境傳說:初心之戰, the grossing seems doing very well.

https://app.sensortower.com/overview/6480158002?country=TW&tab=category_rankings

Am i missing something?

Thank you for your insights.