Mobile revenue roundup - Week 13, 2025

Drecom (3793.T) catalyst is cemented, and investors have absolutely missed it. Top US-traded: CHGG, GDEV, GPRO, BMBL, IQ

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World):

Our Picks and Watchlist

Winners this week

US-traded

Chegg (CHGG) has regularly been showing in the top increases, mostly because their app ranks trended lower late last year and early this year. Still if we look at the past 6 months, mobile operations seems to improve for them:

However, as highlighted - the company has actual TTM revenue of > $600M which seems to be much more than mobile, or if it’s mobile, maybe a lot comes from China on Android stores which we have no visibility.

So not a statistically relevant increase once we take it all into consideration.

Worldwide Markets

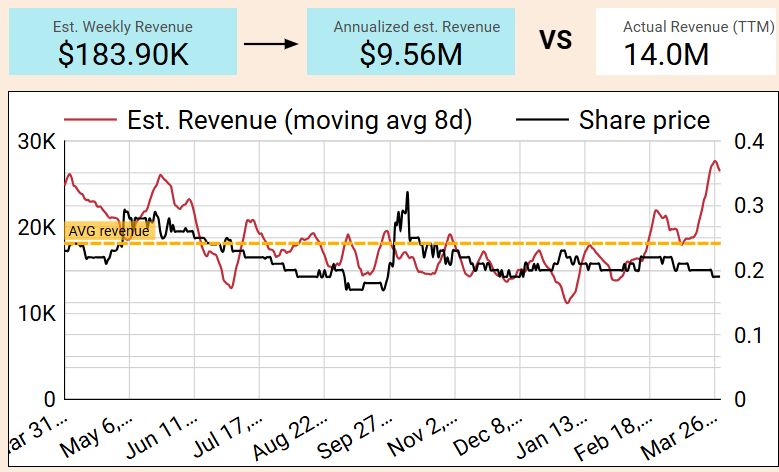

Drecom (3793.T) was covered last week so we’ll keep it short. It’s a clear catalyst for us, with Wizardry Variants Daphne successful release in October and continuing to perform 6 months on. What’s more, it’s now performing in Taiwan and Hong Kong as well, important markets, driving revenue up significantly.

Here’s this week’s graph:

Look at the black line (share price) vs the red line (est. revenue). How can Drecom be worth less today than before Wizardry Variants Daphne launched? It had not been expected.

Investors put too much weight on Disney STEP not being as big a success in our opinion. Resurrecting the “Wizardry” IP has the potential to be transformative for Drecom. We have scooped significant amount of shares around JPY 600.

GungHo Online Entertainment, Inc. (3765.T) has seen a robust weekly estimated revenue boost of 90%, translating to an additional $1.9M. This uptick, primarily driven by "パズル&ドラゴンズ" (Puzzle & Dragons) is however not a catalyst. We’ve see P&D jump up and down the ranks ladder based on new in-game content for users to purchase. As you can see from the graph, it’s not relevant as of now:

Note: we do not include Gravity’s revenue in GungHo’s charts. It’s almost 50% of their revenue.

Feiyu (1022.HK) was covered last week already - they’ve recently launched a new game called “1 Step 2 Steps” which is slightly improving the company’s baseline revenue. It’s good news for them - given they do not launch games frequently. See how revenue baseline is now going up.

At this stage, we will call it significant but not transformational and we did not purchase any shares based of it.

They’ve also released their FY2024 earnings and it wasn’t too exciting to say the least.

Appirits (4174.T) - we looked into it and it’s not a relevant increase.

Ongoing Picks - Watch list

Gala Technology (2458.HK) announced great FY2024 (in particular H2) results as we fully expected, in line with the revenue increases we’ve been spotting all long. We covered it fully here.

Qingci (6633.HK) also announced FY2024 earnings last week. We’d rate it better than Feiyu, but not as great as Gala Technology, which we also expected. However, it was another profitable half, which is what they need to bring back investor onboard. That and a new success.