Mobile revenue roundup - Week 12, 2025

Drecom (3793.T) operations goes from good to GREAT with a top 20 in Taiwan/Hong Kong, and Feiyu (1022.HK) has a mildly successful new launch

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World): Gravity, Bushiroad, Drecom, Feiyu, Enad Global 7)

Our Picks and Watchlist

Winners this week

US-traded

Not much to say, with less than 25% revenue increase for all the companies, there isn’t any catalyst at play. Maybe just worth a recall for $GRVY, which is trading at a bargain.

Gravity (GRVY) was largely covered the past few weeks articles as it was on the top spot 3 weeks in a row. The short story is:

It’s one of our pick on account of being incredibly low valued at a PE of 6, while EV is $0. Market Cap $400M, which is more or less 1.2x their yearly revenue, and 8x their yearly profit)

They have a busy pipeline of games in 2025 again, which they release region by region (SEA, Taiwan/HK, Japan, Korea, Global), and run live operations on, ensuring fairly stable revenue for a mobile app company

Worldwide Markets

Drecom (3793.T) is by far the most interesting company this week. We covered them the few last weeks so we’ll keep it short. Last week, its est. revenue doubled the (already increased) baseline of the past 8 weeks.

And it’s not the recent release of Disney STEP, but a marketing push that drove Wizary Variants Daphne (which was released in October) to climb the chart again, but this time in Taiwan (top 5 mobile spending market in the world) and Hong Kong.

This is significant as it’s looking like Drecom will be able to derive long term revenue not just in Japan, their home turf, but in those countries as well.

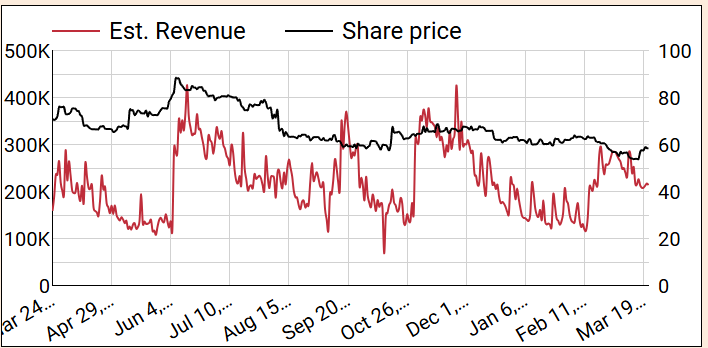

Meanwhile, the stock has taken an absolute beating in the past few weeks (higher expectations on Disney STEP), cf. graph:

This asymmetry between stock movement and their successes is exactly what we’re hunting for. As a reminder, they derive almost all of their revenue from mobile and so this is highly significant. Last earnings, they had QoQ increase of 100%, proving our estimates to be correct.

The only big question and restraint we have is: How much are they spending to acquire users ? Because they’re getting revenue, but are they efficiently getting it? We’ll only know end of April for their quarterly earnings release.

Final thoughts for you: How can the company be worth less today, than end of October 2024 when they started having their biggest success in at least 4 or 5 years? That makes little sense to us, giving they’re doing > 2x revenue and project higher profitability.

Bushiroad (7803.T) tops the chart with an estimated revenue uptick of 267% this week, translating to a $600K boost. But don’t be fooled!

The mobile game "バンドリ! ガールズバンドパーティ!" [BanG Dream! Girls Band Party!] is the star of this spike, and it may look significant if you look at annualizing that $600K.. but we know Bushiroad, because we’ve seen this in the past…Every year, at the same period. So we extended our usual chart’s timeline from past year to past 2 years and.. tadaaa

You can see the spike 2 years ago and last year at the same time right there.

To be clear, we’re not saying it’s not a good company to invest in, we haven’t dived into it at all. But this may look like a catalyst, and it absolutely isn’t. This is likely a yearly big event with their BanG Dream game.

Feiyu (1022.HK) is a tiny ($50M market cap) company of interest to us, as we have longstanding shares acquired during a past catalyst (which, full disclosure, we should have sold when the stock skyrocketed and did not, mistake).

Feiyu’s mobile revenue have been very stable in the past months, mostly driven by their flagship “Defend the Carrot 4” game which is a steady performer.

Here’s the revenue vs share price.

So we can see a significant increase from a $15K/day baseline in the past 3 months, to about $25K/day last week.

Why? They recently launched a game called 1 Step 2 Steps, which has been doing OK.

It’s good news, but far from a major catalyst. We mostly mention it because it’s one of our longstanding pick.

Enad Global 7 (EG7.ST) gets a mention with a 64% in weekly revenue. Looking into it, it’s not a catalyst because:

Big Blue Bubble, their publisher driving most of their mobile revenue, is probably around 10% of the total company’s revenue - so they need a major catalyst to impact the company.

It’s really just the same game (My Singing Monsters) doing slightly better after a pretty bad beginning of the year. Cf chart below, it’s barely above the 52W avg.

Ongoing Picks - Watch list

Qingci (6633.HK) and Gala Technology (2458.HK): Steady as they go. No interesting development this week.