We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World):

Our Picks and Watchlist

Winners this week

US-traded

Gravity Interactive (GRVY) is #1 in revenue increase for US-traded companies this week. If you don’t know Gravity, it’s probably the company we’ve covered the most in the past 4 years. You can find articles and mentions here.

The ultra short version is that it’s one of the most undervalued company out there, trading at cash value whilst being profitable and having had considerable growth in the past 8 years.

What happened last week that it hit the #1 spot ? Simple: Ragnarok M: Classic was released in Taiwan and Hong Kong and immediately became the #1 grossing app on the day. It’s now in the top 10.

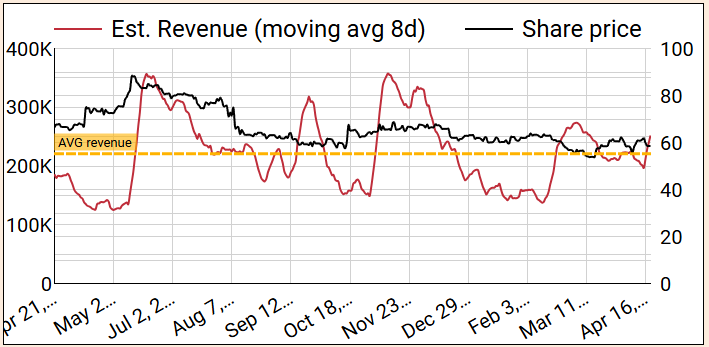

Bear in mind, +27% is fairly anecdotal a revenue increase. If you look at last weeks revenue, it’s only slightly above the 52W average, as the graph shows:

We’ll follow to see how the game performs. Gravity has a very packed year in terms of launches, so they’re bound to appear in the top here and then.

Ohers US-traded companies in the top 5 are not noteworthy with fairly small uptrends (ANGH, GDEV, BMBL and MTCH)

Worldwide Markets

We dived into the top 5 (CMGE, Neowiz, Mixi, Appirits and Globee) data, and there was no real catalyst on the short-term. These are all companies with

significant variance on their weekly revenue

Only a portion of their revenue on mobile

Therefore, we’ll need to see much larger and continued increase before it’s worth looking at the companies as a whole.

We covered Globee (5575.T) last week briefy, as it’s a tiny market cap (<$50M) that seems to derive most of their revenue from mobile. Their increase seems seasonal and event-based, but if we still see it in the top for 2-3 more weeks, we’ll start investigating.

Ongoing Picks - Watch list

Drecom (3793.T) is an ongoing catalyst with expected earnings release in less than 2 weeks. We mentioned them a few times and covered them in the week 12 article a bit more.

We believe their revenue will be well above what investors expect, thanks to Wizardry Daphne Variants doing well not just in Japan, but in Taiwan as well. We believe the Taiwan success completely overlooked by Japanese investors, looking at their conversations on forums.

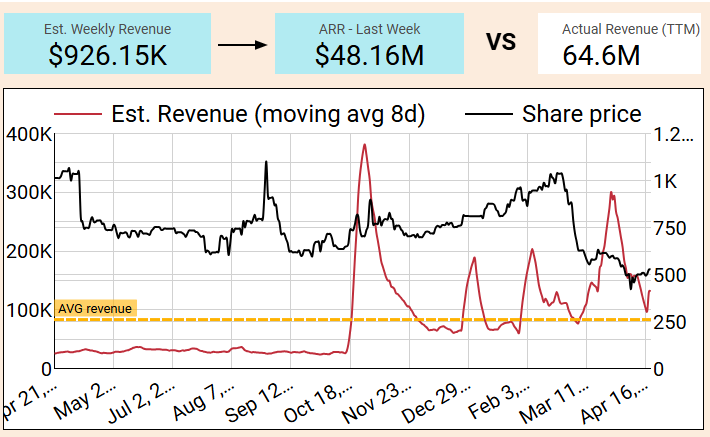

Here’s the latest chart:

You will note that the stock is much lower than where it was before October when the game released, even though they recorded their first profitable quarter in years 3 months ago, and they are about to announce another great quarter, which we believe will be profitable too.

Feiyu (1022.HK), Gala Technology (2458.HK) and Qingci Games (6633.HK) - No update worth covering.