Zen-Game's Mahjong is taking over China

Zen-Game’s Mahjong is taking over China during pandemic

Executive Summary

Zen-Game (2660.HK) is a chinese video game company established in 2013, they specialize in mobile games development and publishing

Since May 2022, Fingertip Sichuan Mahjong has seen a steady increase in popularity and it just won't stop

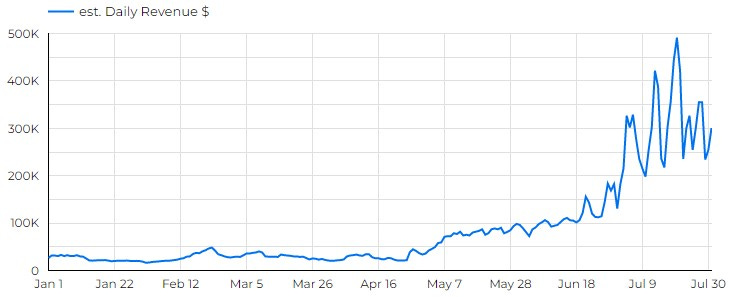

It's currently adding approx. $20M quarterly revenue just on iOS, likely triple that on Android devices

Company was already profitable with a strong balance sheet, is extremely undervaluated (PE of 3) and has 70% insider ownership

It joins our Active Picks list as of 31st of July.

Fingertip Sichuan Mahjong is getting major traction in China

Sichuan Mahjong or Four Rivers Mahjong, is a popular variation of the traditional Chinese tile game, Mahjong. In this version, players use a smaller set of tiles that fit comfortably in one hand, and the game involves the same basic rules as traditional Mahjong, such as forming sets of tiles and scoring points.

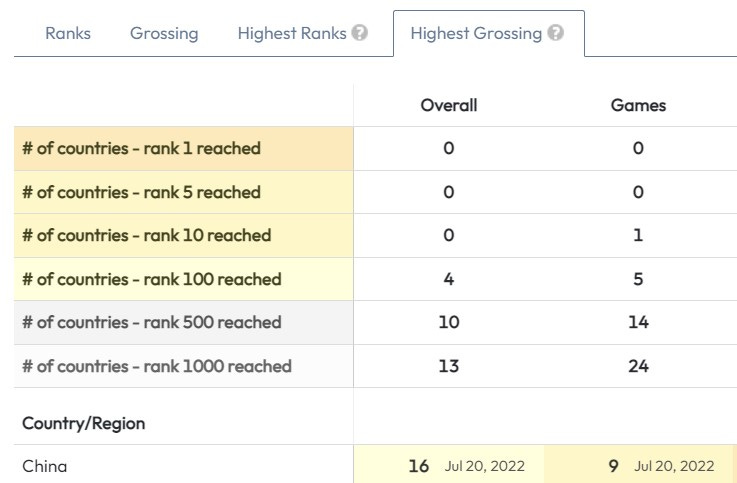

Since May, Zen Game's take on the game on mobile phone has gained a lot of traction. This is not a new release, Fingertip Sichuan Mahjong has been out for nearly a decade now. But it has never been as popular as it is this summer, as the screenshot of data.ai's highest grossing tab suggests!

We think the tough COVID restrictions in China are certainly helping this success, but that as usual, it will bring a very long tail of increased revenue for the company, which will drive their profits, and hopefully, their stock price.

Financials

Our tool is estimating an increase of approx US$250k/daily revenue on iOS only. If we are ultra conservative, we can assume the same increase revenue on android (it's likely much more given the market size). 50'000*90 = gives us US$45M quarterly increase, or US$180M annually, should they manage to keep this success going.

But what does that mean for Zen-Game? Well with an FY21 revenue of approx. US$215M, it means.. a LOT. We expect a tremendous impact on their revenue and profitability.

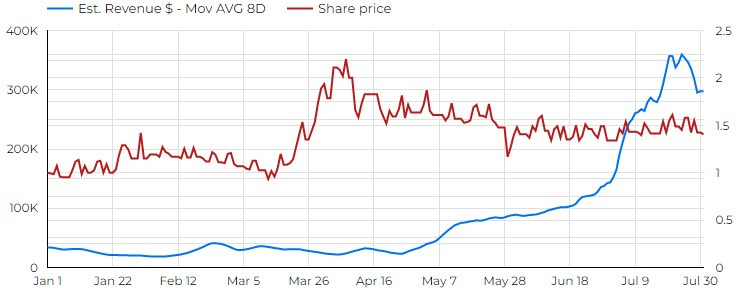

As you can see with the image on below- that revenue increase is undetected by the market and Zen-Game's stock is basically stuck around HK$ 1.5, keeping the company at valuation of approx US$200 millions.

With a PE below 3 and US$160M in cash and virtually no debt, we think it's an absolute steal.

Conclusion

We have rarely, if not ever, seen such an uptrend in a decade-old game. It has gone entirely unnoticed and with such strong fundamentals, we believe this is a very obvious opportunity. It's one for which we need to be patient though: Zen-Game only reports twice a year, as many smaller players on the Hong Kong exchange, so we will likely have to wait until March 2023 to get the full picture for the July-December period.

It joins our Active Picks list and we will update should we see any major changes in our research. GLTA!