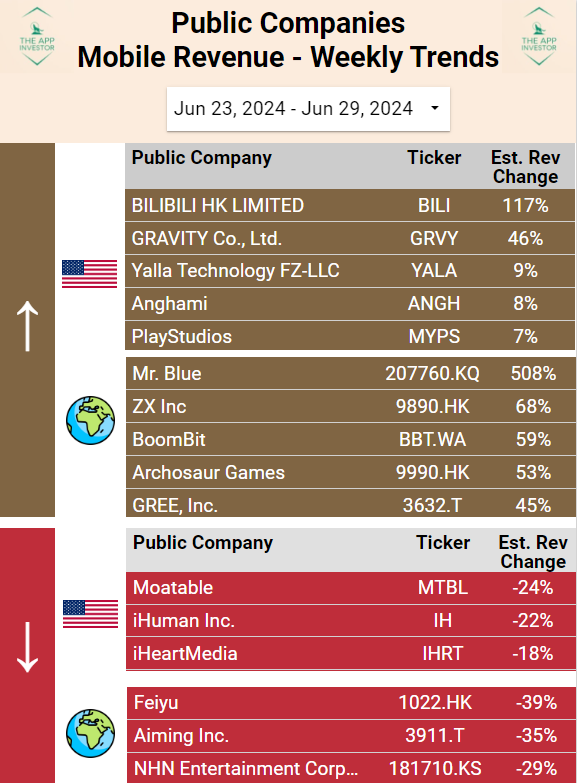

Week ending June 29 - Gravity (GRVY), BILI and Mr. Blue in focus

Gravity's form continue with ANOTHER hit game Ragnarok: Rebirth whilst Mr Blue sees daily mobile revenue 10x!

As you may know, I maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and I estimate their mobile revenue on a daily basis using proprietary tools.

Every week, I will be sharing a screenshot of my “Mobile trends for public companies” dashboard as well as a commentary.

This is one of a series of dashboard used for triage and identifying uptrend or downtrend in weekly revenue, before deep diving into opportunities.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

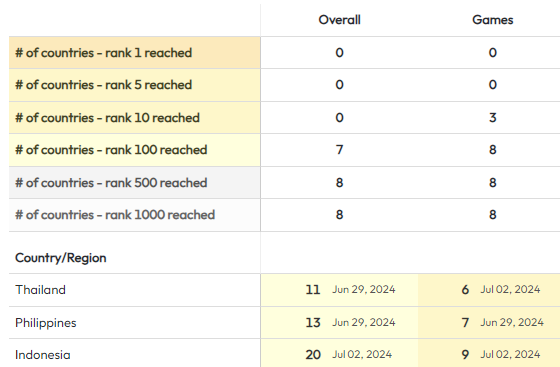

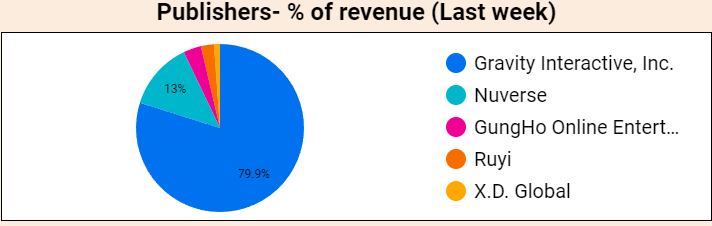

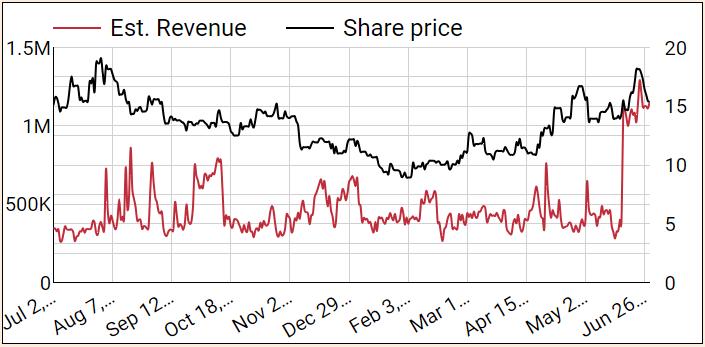

Gravity (GRVY) is still showing an uptrend following the release of Ragnarok, Battle of the Novices in HK and TW 3 weeks ago as well as last week’ release of Ragnarok: Rebirth (Mobile-only MMORPG) in SEA.

Ragnarok: Battle of the Novices is ranked top 5 (Android) and top 10 (Apple) grossing game Taiwan after more than 4 weeks. Strong.

Ragnarok: Rebirth is a top 10 games grossing rank on Apple in the main countries where we saw RO Origin SEA succeed: Thailand, Philippines and Indonesia. Android ranks are still updating

With a PE (ttm) of 5.7, Gravity remains incredibly highly undervalued, yet Q2 and the rest of 2024 is looking stronger and stronger with all these successful releases.

Ragnarok franchise shows no sign of slowing down. In Thailand, they have 3 games in the top 20 grossing chart for games!

Want to read more on Gravity?

Gravity initiation article from October 2022

All Gravity articles

Bilibili (BILI) is still up significantly in revenue thanks to the release of 三国:谋定天下 (translated to Three Kingdoms: Conquering the World), which still is in the top 5-10 in China.

We are quite impressed by how well the game is doing after 3 weeks.

Even with mobile revenue being a fraction of this $5B market cap company, the $3M/day they’re likely bringing in (incl. Android not shown on graphs) is not unsignificant

Keeping on watch list, we may start digging into BILI’s financials and shareholder documents to better understand their business soon.

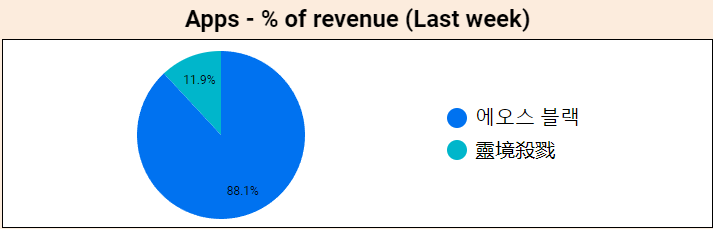

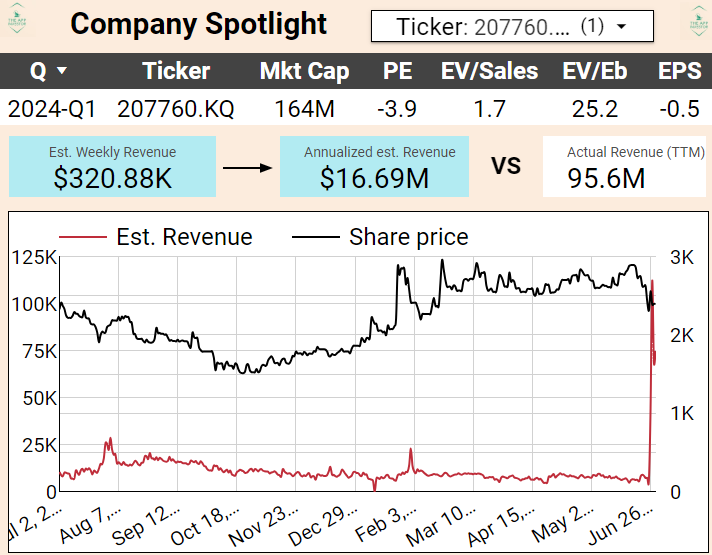

Mr Blue Corporation (207760.KQ) is a korean traded company who saw their daily mobile revenue almost 10x last week, through their subsidiary “BluePotion Games”

Its recently released game 에오스 블랙 (“EOS Black” in english) is getting a surge in popularity in their home market (4th largest in the world!):

We estimate the game drove approx. $320K in revenue last week, which annualized at above $16M.

TTM revenue for this $164M market cap company is about $95M, so this could be rather significant in getting them to profitability

We are not trading in South Korea, therefore we will not be diving into Mr Blue’s business operations. If you trade there, I highly suggest you do.

Losers of this week

For over a month in a row, Moatable (MTBLY) and iHuman (IH) are topping the downtrend board.

Share your knowledge if you’re an investor in one of these 2!Both our picks Feiyu and Aiming are in the downtrend global top 3 as well. Nothing to worry us at this stage, but we would not want to see that continue more than 2 weeks either.

Conclusion

Gravity’s recent pullback makes it quite an interesting dip to buy in our opinion

Bilibili’s extremely popular game in China puts this nasdaq-traded company on our map. We suggest checking their financials and past earnings report.

Mr Blue has a clear catalyst ongoing, if you trade in South Korea, you should have a look at their financials and past earnings for some due diligence!