Week ending July - Korean companies on a hot streak

On the Nasdaq, Bilibili and Gravity's cases are strengthening week after week, whilst Korea's market offers some new opportunities

As you may know, we maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and I estimate their mobile revenue on a daily basis using proprietary tools.

Every week, we will be sharing a screenshot of our “Mobile trends for public companies” dashboard as well as a commentary.

This is one of a series of dashboard used for triage and identifying uptrend or downtrend in weekly revenue, before deep diving into opportunities.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

Sega Corporation (SGAMY) is on the top spot on US-traded stock, however there is nothing to action here in our opinion, looking at the data:

Mobile revenue is a fraction of their overall revenue of over $3B a year, and with a $2.7B market cap, this increase won’t move the needle

Reason for the increase seems to be just regular live operations on their games (e.g. new patch release driving new in-app purchases), which faded quite quickly as the red line below suggests.

Gravity (GRVY) still on an uptrend following following the release of Ragnarok, Battle of the Novices in HK and TW a month ago, as well as Ragnarok: Rebirth (Mobile-only MMORPG) in SEA 2 weeks ago.

(Note: Our estimates of Gravity’s revenue does not take China-Android in consideration and has been directionally correct but it vastly underestimates their revenue).

We covered those last week - no major update on mobile - good performance.

Ragnarok Online, the old school PC game (therefore not featured in our data at all) has been released on June 28th in China and seems very popular based on WeGame rankings. That could be significant revenue for Q3 and onwards.

Want to read more on Gravity?

Gravity initiation article from October 2022

All Gravity articles

Bilibili (BILI) was covered last week - still doing strong thanks to the release of 三国:谋定天下 (translated to Three Kingdoms: Conquering the World), a top 10 in China after a whole month. Impressive.

Doubling of mobile revenue is not insignificant. We suggest doing your due diligence on this one - this may be an opportunity.

Mr Blue Corporation (207760.KQ) is a korean traded company that we covered in last week update. EOS Black (new game) is still doing superbly.

Stock has been tanking, reflecting even higher expectations, or absolute blindness by investors over there. If you can trade in South Korea, we highly suggest you digging into them.

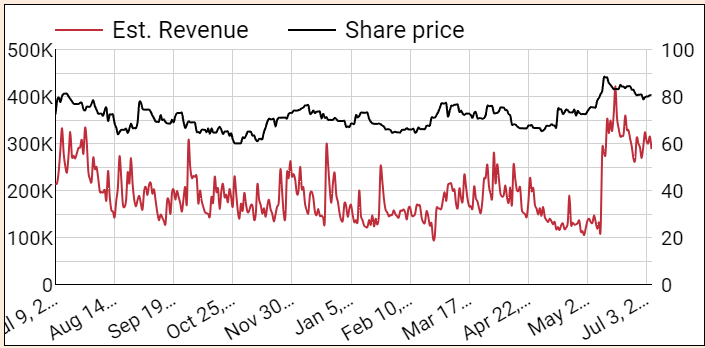

Devsisters (194480.KQ) is a korean traded company that we’ve seen having great stock movements following successful game releases in the past. They just launched CookieRun: Tower Adventures on June 26th with a decent success.

We estimate that they generate about $400K daily from it alone, moving their total daily mobile to the $600-700K range, which is very significant for a company with $220M in TTM revenue.

Stock has reacted briefly but has now tanked. Quite volatile.

Here as well, if you trade in South Korea, we’d suggest digging into it, given this revenue increase is major.

ZX Inc, GREE Inc and BAIOO complete the worldwide top 5.

ZX Inc is a $3.2B market cap and the revenue increase is unsignificant for the,

GREE Inc’s revenue increase is just normal live ops

We’ll monitor BAIOO this week, so far it just looks like normal live ops increase.

Losers of this week

Motable (MTBLY) revenue continues to dwindle for almost 2 month now. We have not dug deeper, we highly suggest you make sure you understand why if you have shares, as it is very significant.

GungHo tops the worldwide downtrend chart today, due to its high volatility (one big hit driving massive revenue on updates). Nothing new under the sun:

Conclusion

Gravity’s position just keeps getting better. We will likely buy future dips.

Bilibili is worth a deeper look - let us know your thoughts on this one!

Korean opportunities with Mr Blue and Devsisters - do you trade there?