Mobile revenue roundup - WK51

NEOWIZ est. revenue up 172%, and we strengthened our position on Drecom and Gala

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners

Loosers

Our Picks and Watchlist

Winners this week

US-traded

No relevant increase this week, after filtering out the companies for which mobile revenue is small fraction of their market cap. Top of the bracket is Anghami (ANGH), but that 19% increase falls into usual order of magnitude for them.

Worldwide Markets

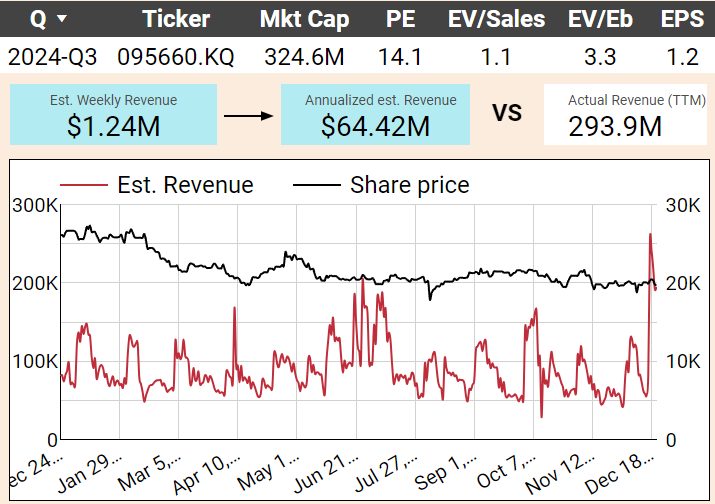

NEOWIZ (095660.KQ) has seen a major weekly estimated revenue growth of 172%, adding $783K. This bump translates to a potential annualized increase of $40.7M, which is 14% of its TTM revenue. There’s a possible valuation catalyst.

Apps driving this increase:

"BrownDust2 - Adventure RPG" is a major player here, with a 609% revenue surge, contributing $811K.

"피망 쇼다운 홀덤 : 텍사스 홀덤, 포커, 토너먼트" [Pmang Showdown Hold’em: Texas Hold’em, Poker, Tournament], launched 16 days ago, also added $54K.

Notice the increase in revenue from BrownDust2

This increase is extremely significant, when compared to their standard deviation of weekly revenue. Historical data indicates a reversal from a previous trend of declining weekly revenues since July.

With an EV/EBITDA of 3.3 and a PE ratio of 14.1, NEOWIZ's valuation metrics remain moderate, potentially attracting value-focused investors.

→ Let’s keep it on watch.

Com2uS Corp. (078340.KQ) has seen a 71% estimated boost in mobile revenue this week, translating to a $2.0M increase. Could this annualized $104.1M uptick, representing 11% of TTM revenue, spark a reevaluation of its market cap?

The app "Summoners War" led the charge with a 93% rise, adding $1.2M

"컴투스프로야구V24" [Com2uS Pro Baseball V24] grew 76%, contributing $323K.

Despite volatile norms, it is a significant spike, marking a departure from recent stable weekly returns since October. With an EV/Sales ratio of 0.4 and EV/EBITDA at 2.4, the company's valuation appears modest, potentially drawing our interest if this growth pattern persists.

MAG Interactive (MAGI.ST) shows up a 2nd week in a row with an estimated 67% bump in weekly mobile revenue, which translates to an annualized $1.8M—a 7% lift against its trailing twelve months (TTM) revenue. That is no major catalyst per say, but should that upward trend continue (see the red line below), it would likely have an impact on their top and bottom line.

CROOZ, Inc. (2138.T) is riding a wave with a 60% spike in estimated mobile app revenue, translating to an additional $79K this week. This uptick, if annualized, adds roughly $4.1M to their TTM revenue—a modest 4% boost yet noteworthy for a company with a $53.2M market cap.

The standout performer? ERGOSUM(エルゴスム), launched a mere 27 days ago, skyrocketed with a 1028% increase, adding $33K.

This revenue leap is very significant compared to historical fluctuations. So let’s keep an eye out on CROOZ.

Conservative EV/EBITDA of 4.8 and a PE ratio of 8.6, CROOZ’s valuation metrics suggest room for re-evaluation if growth sustains. The stock has not captured the momentum.

Loosers this week

No company met our minimal thresholds for mention this week. Tapinator (TAPM) is so tiny ($1.6M market cap), we’d only look at it if we saw some 1000% increases ;-)

Ongoing Picks - Watch list

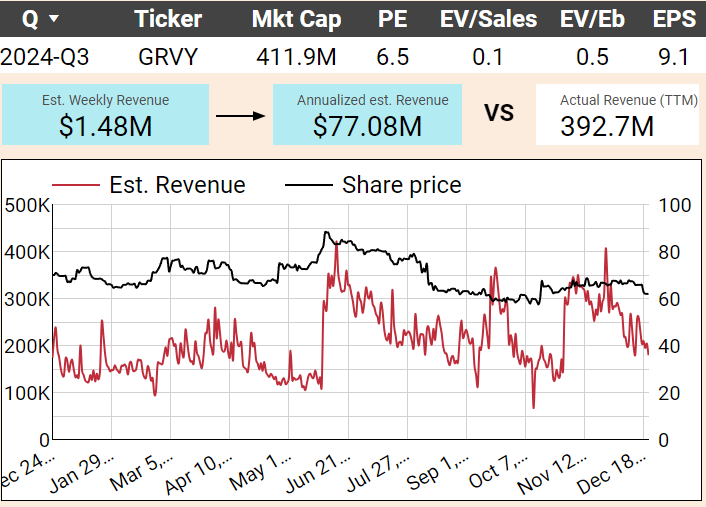

Gravity (GRVY) is down 12% vs last 7 weeks, as the latest Rebirth and THE RAGNAROK releases are slowly loosing steam. It is as expected. Q4 remains a strong quarter, and the company’s valuation one of the lowest there is in the space with PE of 6.5 and EV/Sales of 0.1.

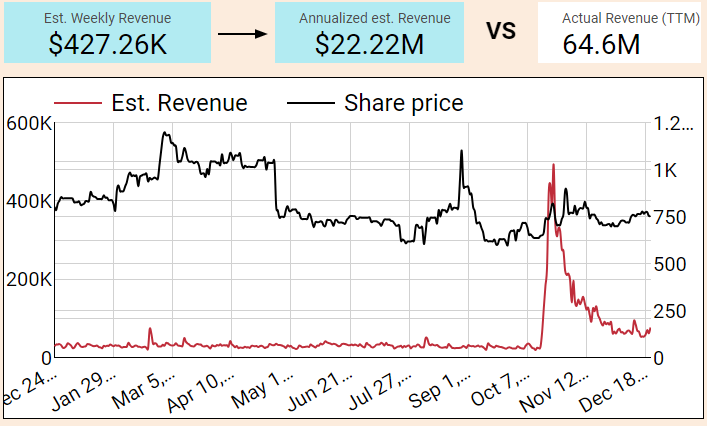

Drecom (3793.T) keeps stabilizing its revenue at over 2x their baseline, following their most successful launch in years. We’re very excited for quarterly earnings on that one. The big question mark is how much they spent in user acquisition, but our little finger says not that much - as they were taken by surprise by their own success. Strong contender for star of the quarter!

Gala Technology (2458.HK): Revenue reversed its downtrend, which is a relief. We bought more shares on the prospect of H2 earnings beating expectations quite massively, as the stock has flat-lined.

Chart only considering iOS China (so triple that red line if you want an assumption of iOS + Android in China)

Feiyu (1022.HK), Qingci (6633.HK): Nothing to see. All stable.