Mobile revenue roundup - WK 49

We're back. Drecom's Wizardry game is loosing steam. Feat. KLab, Mobile Factory and EG7.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Winners this week

US-traded

GDEV Inc. (GDEV) experienced a notable 29% estimated revenue growth this past week, adding $560K to their coffers—translating to an annualized boost of $29.1M or 6% of their TTM revenue. This jump is primarily driven by "Hero Wars: Alliance," which surged 36%, contributing $509K. This revenue variation isn’t very significant compared to its standard deviation. Hard to catch on the daily revenue chart:

GoPro, Inc. (GPRO) has seen a notable 27% estimated weekly revenue growth, translating to an additional $161K. The app driving this surge is GoPro Quik, with the same 27% increase. This change is very significant compared to its typical revenue fluctuations, hinting at a potential new trend. But the $8.4M annualized revenue increase is just 1% of GoPro's TTM revenue, it will not sway its valuation.

Worldwide Markets

NHN Entertainment Corporation (181710.KS) has seen a notable estimated weekly revenue growth of 107%, translating into an annualized increase of $98.5M—a 5% bump against its TTM revenue of $1.8B. This uptick, driven primarily by apps like "한게임 섯다&맞고" (up 187% to $1.1M) and "한게임포커 클래식" (up 187% to $997K), signifies a very significant variation, hinting at a potential new trend.

Enad Global 7 AB (EG7.ST) has seen an estimated 102% weekly revenue growth, driven largely by its app "My Singing Monsters." This surge adds a notable 11% to its TTM revenue, a potential valuation catalyst given its $126.5M market cap. The revenue spike, whilst significant, is not the first we’ve seen of My Singing Monster getting some love. Blip or promising trend? We’ll see.

Mobile Factory (3912.T) has seen a noteworthy estimated weekly revenue growth of 66%, primarily driven by the app "駅メモ! - ステーションメモリーズ!-" (Station Memo! - Railway Location Game), which added $96K this week. This surge represents a very significant variation compared to its usual fluctuations, suggesting a potential new trend rather than a blip. With an annualized revenue increase of $5.0M, this growth could meaningfully impact its valuation given its market cap of $41.7M.

KLab Inc. (3656.T) has seen a 59% estimated revenue growth this past week, driven by significant increases in their popular apps. "Captain Tsubasa: Dream Team" surged by 97%, adding $131K to the week's revenue. This uptick is slightly significant compare to usual fluctuations, suggesting it might not be sustainable long-term. However, annualizing the increases would give them an extra $11.0M, representing an 18% boost over their TTM revenue. That’s could be a valuation catalyst for KLab, considering its current market cap of $69.8M.

CAVE Interactive (3760.T) has seen an estimated 49% bump in weekly mobile revenue, adding $124K to the coffers. This spike, driven by "東方幻想エクリプス" (Touhou Fantasy Eclipse) and "キングダム 乱 -天下統一への道-" (Kingdom Chaos - The Road to Unification), could be a catalyst given its 8% impact on their TTM revenue. The revenue variation is quite significant, hinting at a possible trend shift.

Loosers this week

No company passed our minimal thresholds for mention. FYI - our thresholds are based on:

Is the increase significant enough wrt TTM revenue and market capitalization?

Is the increase significant wrt past revenue variation, i.e. we compare the increase vs the variability in their weekly revenue in the past (standard deviation).

Follow Ups / Watch list

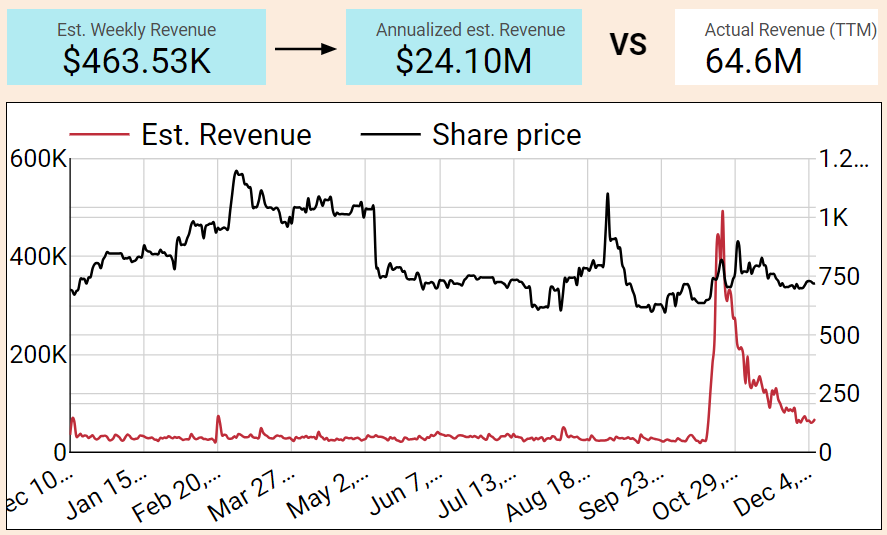

Drecom (3793.T) have struggled to keep the heat going with their Wizardry Daphne game. They’re still on a revenue x2 baseline compared to before the release, but as you can see from the below graph, it could have been significantly more. That being said, this last quarter for calendar year 2024 will crush anything they’ve had in the recent years - so we scooped a few shares.

Gala Technology (2458.HK): The chinese EA Sport lookalike has seen a slight pullback of its revenue since peaking in September. However their weekly baseline is still significantly higher than in H1, which bodes real well for their H2 earnings.

Chart only considering iOS China (so triple that red line if you want an assumption of iOS + Android in China)

And investors haven’t noticed at all yet, as highlighted by the stock (in black) not reacting.Gravity (GRVY) has had a good few weeks, often showing up in the top thanks to releases of Rebirth as well as THE Ragnarok in various regions. Q4 is looking as solid as Q3 so far.

Conclusion

No major catalyst this week. Watchlist stocks stays on watch!