Mobile revenue roundup - WK 36

CMGE exits the watchlist, CHGG back to business as usual and BILI falls behind its new mobile revenue baseline, but that's OK.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

Chegg (CHGG) tops the list with a 60% increase in est. revenue from mobile, but it follows a streak of nearly 2 months of their revenue sinking so it seems to just be business back to normal. Also it’s just a small part of their total revenue based on our data - no action.

CMGE (0302.HK) or China Mobile Games and Entertainment tops the international chart a 3rd week in a row, with last week ending at +75% against the last 6 weeks average thanks to the successful release of 斗羅大陸:史萊克學院 in Taiwan and Hong Kong (see previous weeks).

A quick look at the chart tells us the honeymoon phase is over with this game, and revenue has dropped significantly since 4th September:

CMGE exits the watch list after just a week, as clearly this game won’t be driving meaningful, long-term revenue increase vs baseline

DeNa (2432.T) is a japanese provider of mobile portal and e-commerce websites, that also dabbles in video games publishing. It’s showing at the top two weeks in a row following Pokemon Master EX climbing up the ranks. We covered last week why it was not worth a deep dive at that point, and that is still the case. Also - we already see game going back down the ranks, as expected, hence the revenue dropping:

Coly (4175.T)’s +60% seems to be just business as usual. Only reason we mention it is how the stock has, in the recent time (this Spring) rapidly reacted to surge in ranks (or rather: to a successful game release likely impacting their top and bottom line, which is what we’re tracking with ranks)

We glanced at the other companies in the top list, and there was no catalyst worth diving into beyond those above.

Loosers this week

We checked - nothing new under the sun. Worth mentioning:

Bilibili (BILI) was expected to show up following weeks of stronger showing in the winners group following a new hit game. They now have to compare against a new baseline for their mobile revenue. Nothing to worry here

Mobile publishing revenue is a fraction of their business

Their est revenue (cf chart below) is back to pre release.

ZX Inc: Their new successful game wasn’t a catalyst on the way up, it isn’t one on the way down. Way too small vs their total revenue.

Follow Ups / Watch list

Gala Technology (2458.HK) is establishing a new revenue baseline with both baseball (released in June) and basketball (released 3 weeks ago) showing signs of long-tail. Slight drop last week.

2 months into H2, it’s looking like their strongest quarter. There’s no rush though, they won’t report H2 2024, before March 2025, and the stock does not get coverage.

Chart only considering iOS China (so triple that red line if you want an assumption of iOS + Android in China)

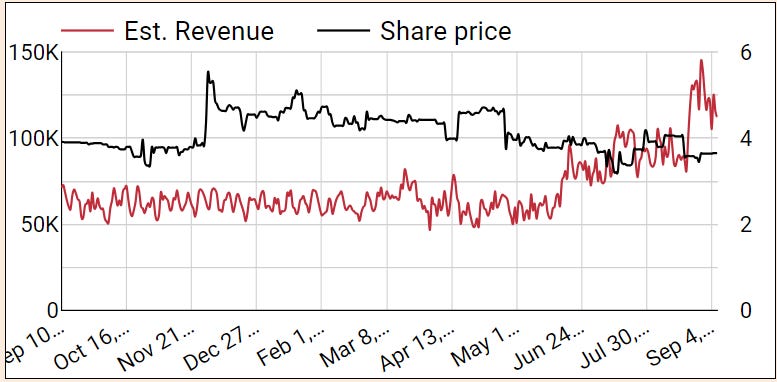

ZenGame (2660.HK) being on our watchlist is explained by the growing asymmetry forming between their results and their stock/company value. We’ll just post the weekly chart going forward - with the reminder that this is a company with a PE of 4 and > 30% net profit margin that pays a yearly dividend, and that you can 3x the daily revenue to get an estimation of iOS + Android since they are only in China.

That’s all - not too exciting a week. No new company on watchlist, CMGE exits it.