Mobile revenue roundup - WK 35

Spotlight on CMGE, ZenGame, Gala Technology, and a quick wave from SEGA and DeNa

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

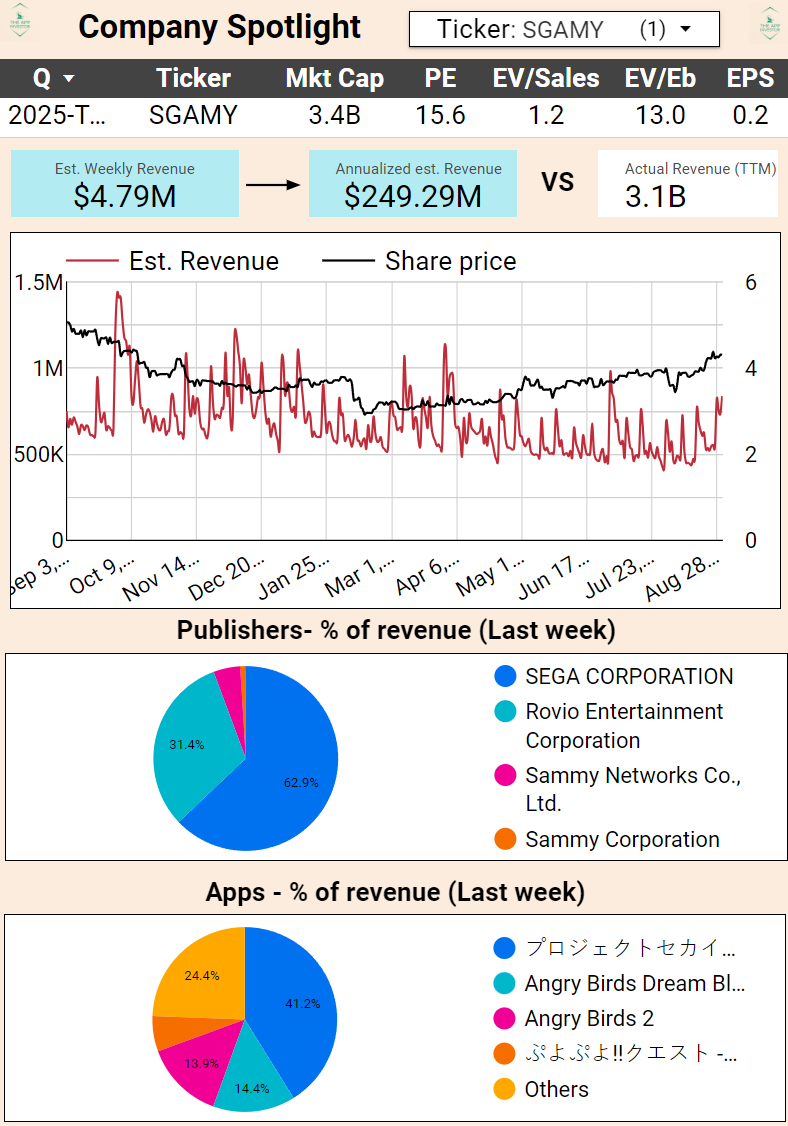

SEGA (SGAMY), a gaming company with a strong legacy in both arcade and video games, hits #1 spot this week with +27% weekly est. revenue. Diving into it, it’s north worth a deeper look:

There’s no real catalyst, it appears to have been a slightly better week after a pretty stale August month on their mobile games

Revenue we are able to attribute from mobile gaming is < 10% of their total revenue, even considering the Rovio angry birds acquisition. It may be more in reality - but argument #1 prevails.

That being said, if you’re interested about SEGA corporation,

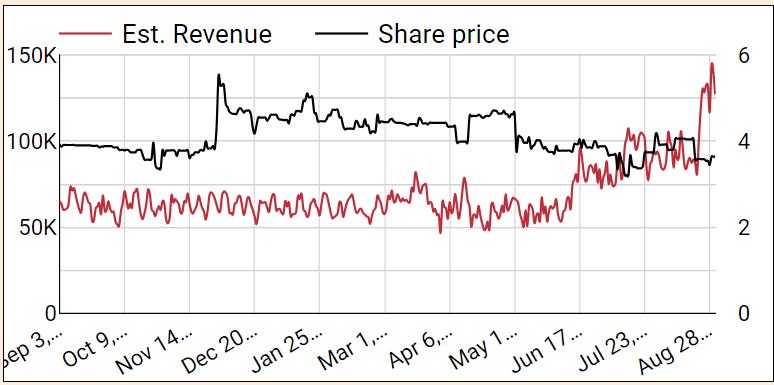

does an A+ job covering their progress and results, and other companies in the industry.Here’s there full chart for those interested in SEGA:

CMGE (0302.HK) or China Mobile Games and Entertainment tops the international chart a 2nd week in a row, with a whooping +341%.

We covered it last week, it’s thanks to the successful release of 斗羅大陸:史萊克學院 in Taiwan and HongKong.It’s a fairly small catalyst compared to the overall business size, approx. $150K/day is our estimate, vs their revenue of about $1M/day TTM.

So whilst it’s not one of these “potential 3x catalyst” for sure, it remains progress wrt their mobile division, and the game shows no sign of loosing steam yet.

Stock has been beaten down (like a lot of chinese gaming companies, and we feel the pain), and certainly has not picked up on this. It’s unclear whether the market will get more favorable to chinese companies, though.

So CMGE enters our watch list. Here’s the chart:Next steps would be, if the game’s success continues, to dive into:

The game ownership: are they developer and publisher, or just publisher? That changes the % of revenue they would make of it

Company’s financials

DeNa (2432.T) is a japanese provider of mobile portal and e-commerce websites, that also dabbles in video games publishing.

The increase in revenue is driven by a resurgence of Pokemon Master EX, and we’re not interested in a deeper dive because, in order of importance:We’ve seen this exact pattern happening every 3-4 months with DeNa and Pokemon Master EX. Must be some sort of big update. It’ll fall down next week.

It seems they tend to publish games they do not develop as well, watering down their actual portion of our est. revenue

Mobile app publishing is probably less than 30% of their overall revenue, and with a $1.2B market cap, this won’t be significant.

Here’s the chart:

Happy to see our previous pick ZenGame (2660.HK) keeping the good form.

Their stock has taken a plunge and given they are one of the most profitable and lowest valuated video game companies out there, paying a sweet dividend every year, we’re adding ZenGame to our watch list again. This is a company with a PE of 4, a net profit margin oscillating between 30% and 40% and a formidable balance sheet.Is there any catalyst there? None. But the growing asymmetry between market value and company performance is worth noting.

We glanced at the other companies in the top list, and there was no catalyst worth diving into beyond those above.

Loosers this week

We checked - nothing new under the sun. Worth mentioning:

Mr. Blue (207760.KQ) is 3 weeks in a row in the top losers. This reflects their game release which peaked high in the Korean ranks but very quickly lost steam.

Follow Ups / Watch list

Gala Technology (2458.HK) is at +40% weekly revenue again vs its baseline this week, thanks to their new Basketball game 美职篮巅峰对决 (NBA Showdown) that was out 2 weeks ago. Game seems to keep players entertained, and has the looks of a long-tail revenue game.

Chart - only taking iOS China (so triple that red line if you want an assumption of iOS + Android in China):H2 is already looking really strong in terms of revenue for Gala Technology. The big question is how much they’re spending to get there.

Its valuation isn’t as favorable as ZenGame or Gravity, but with TTM revenue of $83M and $8.4M in net profit for a market cap of $67M and an EV of $25M by our estimate, it deserves a deep deep look. We think their profitability could vastly increase asThey should start maintaining their sport franchise rather than starting new ones, not unlike EA

They are just in China today - and can expand quickly to HK and TW to start with