We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

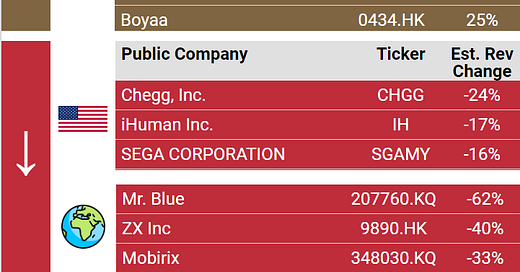

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

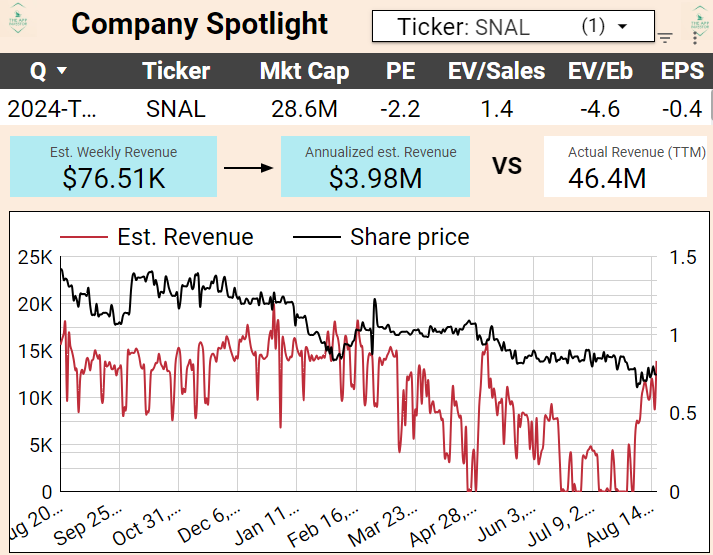

Snail Inc. (SNAL) is one of the smallest companies on our of publicly traded companies database that are involved in mobile apps, with a sub $30M market cap.

They focus on free-to-play online games, with their flagship remake of the ARK Franchise (ARK: Survival Evolved and ARK: Survival Ascended).Only a fraction of their revenue is mobile, likely about 10%

A quick glance at the chart below show the '316% increase’ is really following poor weeks. Also, we’re in the $0-$15K daily revenue ballpark, so it’s expected to be volatile.

Doesn’t make it to the watchlist.

On the international markets

Rastar Mobile (300043.SZ) is back for a 3rd week in a row. now, with their just released 三國:戰地無疆 (Three Kingdoms: Battlefield Without Borders) still leading the charge-

Chart for mobile revenue:

Same as last week, we ignore Rastar because their mobile revenue is just too low to move the needle… today. And we can see the game is already dropping in revenue.

X.D. Network (2400.HK) was still hot last week - following the release of Sword of Convallaria which launched on July 31st. The game is fast loosing steam as you can see from the red line of est. revenue dropping.

Charts:Still - we remain above the est. revenue baseline, in a significant mobile sector for X.D.

Stays on watchlist, should a) their games pick up momentum again b) stock go down, given that’s 2 hits in a row (cf last week’s report).

Other winners: We had a quick look at their charts, nothing to report really there.

Loosers

Nothing too unexpected there. ZX is not worth our time, their mobile gaming division is not the one bringing in the dough.

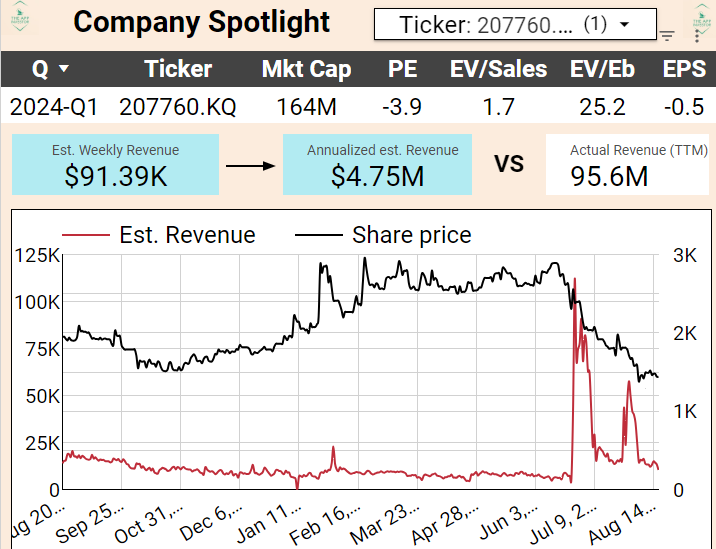

Mr. Blue (207760.KQ) ‘s new game keep on loosing steam, forcing them at the top of the loosers list this week. See the chart:

Given how the stock has spiraled down this summer, this could have been a welcome catalyst for Mr Blue, but they seem out of steam.

Important to note that most of their revenue does not seem to be coming from mobile, so you’d need to deep dive on their other segment if you were to make any decision here.

Follow Ups

Not much to say, beyond X.D, there’s only Gala Technology (2458.HK) is on our watch list, with steady revenue increase, a decent traded volume, interesting valuation, high insider ownership and a dividend, it has the hallmark of a great potential stock, should their revenue keep on increasing, We keep an eye.

Conclusion

Not too exciting a week. Snail just made sure we remembered they existed. At $30M market cap, they need a single hit to transform their mobile unit.

XD is losing steam, Gala Technology is steady.

Liking the revenue roundup this week. I was looking through the closed picks and noticed that Zengame is trading really cheap as of recently. Any chance we can look at the recent IOS revenue to look for another opportunity?