Mobile revenue roundup - WK 32

Another hit by X.D Network and Rastar's new 3 Kingdoms impresses

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

Nothing interesting on US-traded stock - it’s looking like a redo of last week. Minimal increase for Moatable and NetEase but no catalyst there.

On the international markets:

Rastar Mobile (300043.SZ) is back 2 weeks in a row. The $370M market cap company has had a great week following the release of 三國:戰地無疆 (Three Kingdoms: Battlefield Without Borders) .

Chart for mobile revenue:

Rastar hasn’t seen such a success in over 6 month on mobile, however two things are clear:

The game' ranks have already started their downward trend. That’s too soon to call, though.

Given their TTM revenue of $236M, the highlighted increase is not significant.

Skippity skip Rastar again.

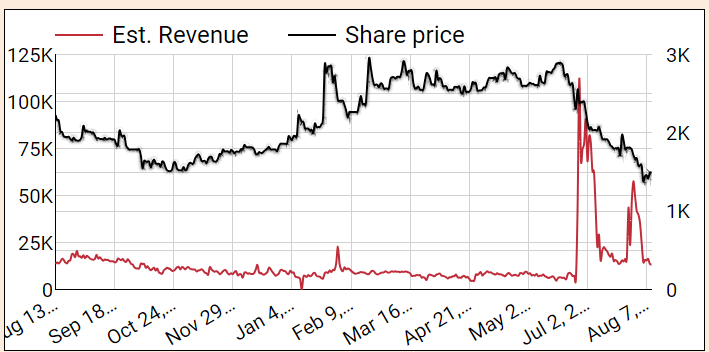

X.D. Network (2400.HK)’s estimated revenue went up drastically following the release of Sword of Convallaria which launched on July 31st. It’s a worldwide release and the game even broke the top 100 in the US and top 20 in Japan and Korea.

Chart:What do we see?

This release is extremely impactful for X.D. revenue, hitting est. revenue of almost $1M a day, for a company with a TTM revenue of $466.7M.

Stock has already gone up, as soon as the game release was clearly a success, maybe even before (see how the black line moves up before the red line). Investors were on the prowl. This is probably because the game had been released with success a year ago in Taiwan and Hong-Kong as well as China.

This success comes on the tail of another major hit in May-June which I believe we covered here :出發吧麥芬-線條小狗聯動 (Let’s go, Muffin-Line Puppy Linkage). It’s still a top 10 in HK and TW.

Stock has already moved up, so we’ll put XD in our watch list. It’s a company that’s quite hard to fully reconcile their mobile revenue, as they regularly publish other developer games, meaning part of the revenue is shared. A deeper dive is required, which we’ll do should the game continue its current performance. After all, 2 successes in a row could vastly improve their prospects as a rapid glance at their financials seem to indicate they’re struggling with profitability.

Loosers

Nothing too unexpected there. ZX is not worth our time, their mobile gaming division is not the one bringing in the dough.

Mr. Blue (207760.KQ) seeing a drop following their latest release (which saw them in the winners list). As you can see from the chart, it was short lived.

Stock has been on a ski trip going downwards for 2 months now, so really investors were not expecting BluePotion Games to succeed. Seems to me they did better than expected.

Follow Ups

Gala Technology (2458.HK), our asian baby-EA Sport, is still heaving a nice momentum, with their diversified portfolio of sports game bringing more and more revenue.

That steady increase will only show in H2, so there’s still quite a lot of time until the market really realizes it, as H1 seem fairly ordinary (see how flat the red line was).But given they make almost their entirety of revenue from mobile and we are able to discern a very sustained and steady increase in our mobile revenue estimate, it is likely Gala will stay in our watchlist for a long time. Heck, a few more months of this and we may dive deeper and decide on initiating a position.

Conclusion

XD deserves a spot on our watch list - that’s 2 games hit in less than 3 months, and they could really impact their H1 and H2 earnings. But the stock has already made some move. But should it retract, it’ll warrant a further look.

Gala Technology has earned a long-term spot on the watchlist after over 2 months of sustained increased revenue vs their previous baseline. We believe they are making at least 30% more in H2 than in H1 so far. You heard it here first!