Mobile revenue roundup - WK 31

Quiet on the mobile front, whilst Gala Technology gets rewarded by investors for their successes

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The % shown is an increase/decreased from last week’s estimated mobile revenue and and the average of the past 6 weeks of mobile revenue.

Winners of this week

Nothing interesting on US-traded stock - this week again. Minimal increase for Moatable, NetEase and iHuman but no catalyst there.

More dynamism on international markets, however after a rapid dive into each of them, they’re not going to be worth a deeper look:

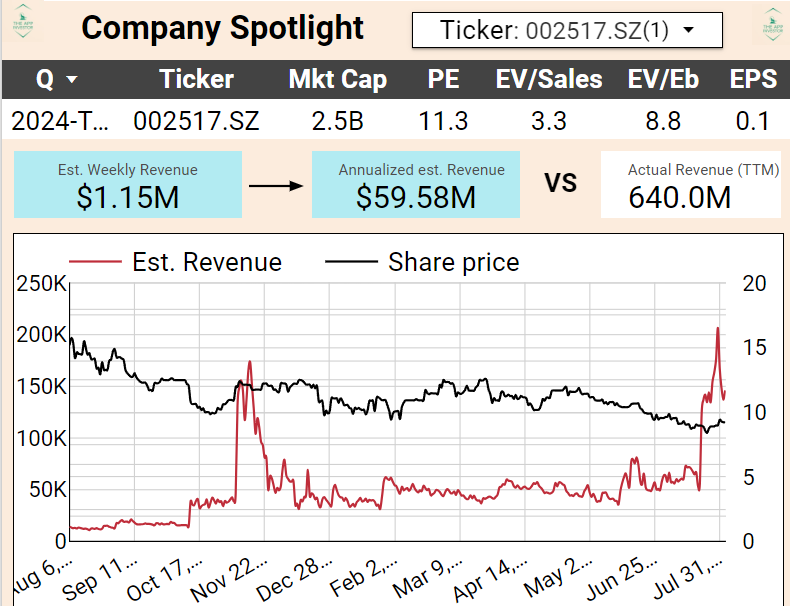

KingNet (002517.SZ) revenue spiked up +126% last week, following 仙劍奇俠傳:新的開始 (Legend of Sword and Fairy: A New Beginning) going up the ladder in Taiwan, Hong Kong and Macau.

Looking at our data, KingNet is valued at above $2.5Bn and has TTM revenue of $640M, so even considering there’s probably China revenue we’re missing, that move from $50K/day to $150K/day isn’t significant enough to dig in.

Rastar Mobile (300043.SZ) is a $370M market cap company which saw a surge in est. revenue (+121%) from their just release 三國:戰地無疆 (Three Kingdoms: Battlefield Without Borders) last week with the game hitting top 10 in Hong Kong and top 30 in Taiwan.

A quick glance at the company’s numbers tells us it’s not a catalyst worth looking into:Indeed, it’s small potatoes compared the the companies total revenue of $236 in the last 12 months. Skippity skip.

Nexon (3659.T) is up 69% on an estimated revenue weekly basis but that’s an $18B juggernaut. That increase is not a catalyst either against the backdrop of their entire gaming business. See for yourself:

Follow Ups

FriendTimes (6820.HK) were on our watchlist following the release of 墨剑江湖 or “Ink Sword” in China. The game has dropped down the order and we don’t think the previous’ weeks anomaly is enough to keep it on our watchlist. See for yourself as estimated revenue (in red) aren’t keeping up:

Devisters (194480.KQ) gets off the watchlist as well. It was on our radar a few weeks back with their new CookieRun game (Tower of Adventures). It does not seem to have the steam to be a game changer for the company anymore:

Gala Technology (2458.HK), our potential asian EA Sport lookalike, has seen some love from the market for good measure. We haven’t actioned it but in the last 2 weeks the stock is up 22% against a falling tech market backdrop. Impressive. It makes sense with their performance. We’re still due a deep dive on them to decide on whether they enter pick territory.

Did someone here buy some Gala?

Gala’s top mobile games by revenue share:

Conclusion

FriendTimes, DevSisters are out of our watchlist

Gala Technology is on fire both in Ops and in stock! +22% in 2 weeks, and strong results.