Mobile revenue roundup - Week 7, 2025

Imagineer (4644.T) tops the chart with a new release, while Devsisters catalyst is confirmed. Blitz coverage of GRVY earnings, too.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World)

Losers (US/World)

Our Picks and Watchlist (Gravity, Drecom +Gala Technology Feiyu, Qingci)

Winners this week

US-traded

Chegg (CHGG) can’t seem to leave the top spot for US traded stock. There for 4 weeks now - but as we’ve mentioned previously, they had a really poor December and January. Quick look at the chart it’s clear there’s no catalyst just yet, and that it’s only a fraction of their revenue.

Other companies (TAPM, MTCH, WW, PLTK) in the top 5 seem to be just standard deviation movements.

Worldwide Markets

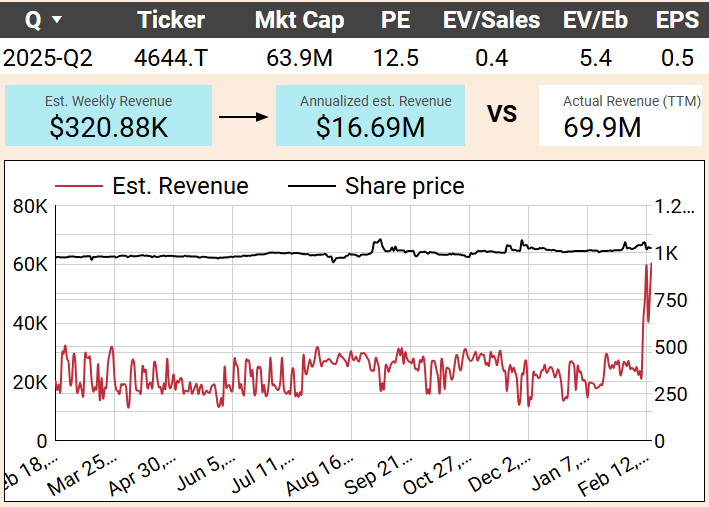

Imagineer (4644.T) is #1 worldwide this week, and is quite an exciting move. An estimated 134% boost in their weekly mobile revenue, adding $184K, a substantial leap from their previous average of $137K. This uptick, if annualized, could increase their TTM revenue by 14%, a potential catalyst for valuation considering their market cap of $63.9M. And that’s not considering the fact that we’re clearly are lowballing their revenue in the past.

This is clearly significant when you look at the revenue over the past 365 days:

What happened? MedarotS happened! New game release, “MedarotS - Robot Battle RPG” is finding reasonable success in Japan, driving over 50% of the totalrevenue last week.

With a PE ratio of 12.5, Imagineer might catch some eyes if this revenue surge sustains. Clear move into our watch list!

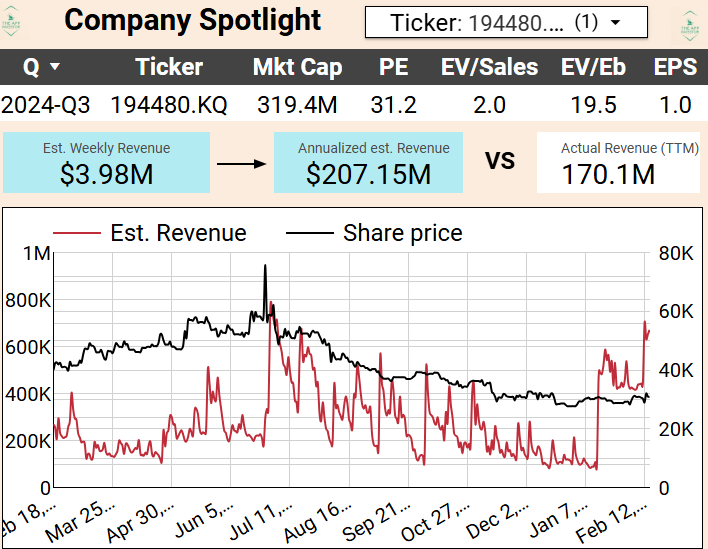

Devsisters (194480.KQ) is starting to look like a real catalyst. Chart first:

Given the increase is not even a new game but CookieRun:Kingdom, this is even more surprising.

It’s sitting at 52W low still, so if you invest in Korea, you should definitely have a deeper dive, because the market hasn’t reacted yet.

Mynet Inc (3928.T) has caught our attention this week with a notable estimated revenue growth of 51%, translating to an additional $63K. This uptick is quite significant against its TTM revenue of $57.2M,.

The standout performer is "国盗り合戦-戦国x位置ゲーム!電車や旅行で全国制覇を目指せ!" (Conquer the Nation - Sengoku x Location Game), which saw a revenue increase of $25K, marking a 156% boost. Not a new release.

With a PE ratio of 12.8 and an EV/Sales of 0.4, the company has an interesting valuation. However, looking at the chart, his seems fairly close to standard deviation and not a catalyst for now.

Loosers this week

Nothing worth worrying about for the ones in the list. They’re not majorly mobile players.

Ongoing Picks - Watch list

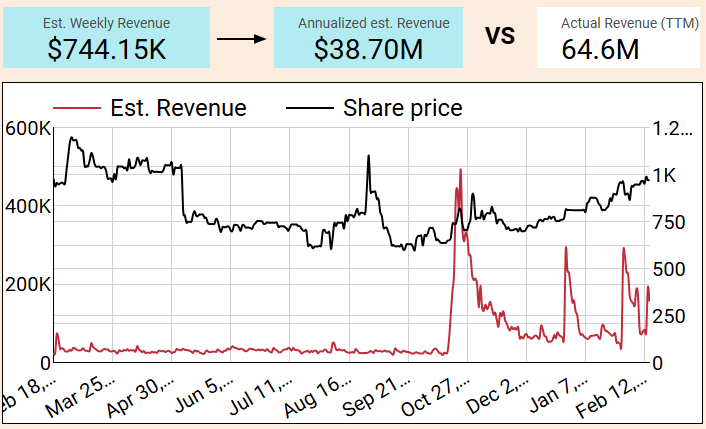

Drecom (3793.T) is our hottest pick right now - with momentum both in the app rankings and on the stock market.You can easily see how the Wizardry Variants Daphne release end of October triggered the stock moving up over the past 3 months:

So long as we still see those live game ops driving the app grossing to better ranks (cf. spikes in revenue estimates in red), we’ll remain positive on Drecom.

Gravity (GRVY) - Gravity had their earnings on Friday. Presentation here. We mentioned last week that “Q4 will be quite close to Q3” on revenue, and we were dead on, basically flat.. Operating margin was disappointing:

However cash increased significantly. We’ll probably have to wait until the full FY24 report to fully understand what’s happening with the cashflow and potential royalties from China.

They’re still doing nothing with that cash chest. beyond investing in their new games. Of which there are MANY. The 2025 pipeline is stacked with both additional country launches and new games. Even re-launches, with Rebirth relaunching in SEA in Q2.

Honestly, we think the bigger games are rather going to be towards end of 2025 and 2026. Ragnarok 3, Eternal Love 2, Project Abyss - those are the ones we’re most excited about.

Operation-wise, last week Gravity launched Rebirth in TW/HK markets and a new game, Ragnarok M: Classic in SEA (TH, PH, ID etc.).

Ragnarok: Rebirth is #1 in download - to be expected, but isn’t monetizing particularly strongly for now. We should expect at least a top 20 grossing from a Ragnarok game in Taiwan and Hong Kong.

Ragnarok M: Classic had no problem securing a top 5 downloads and is already top 10 in revenue in Thailand and the Philippines. We’re quite far from Origin-like success, but that’s 6 Ragnarok Games in the top 100-150 revenue in those countries now!

—

Others:

Qingci (6633.HK), Gala Technology (2458.HK), Feiyu (1022.HK) - nothing to declare, no significant mobile launches.