Mobile revenue roundup - Week 6, 2025

Drecom (Japan) is #1, breaking out their revenue pattern, and so does Devsisters (Korea)! Meanwhile, GRVY has earnings coming up.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

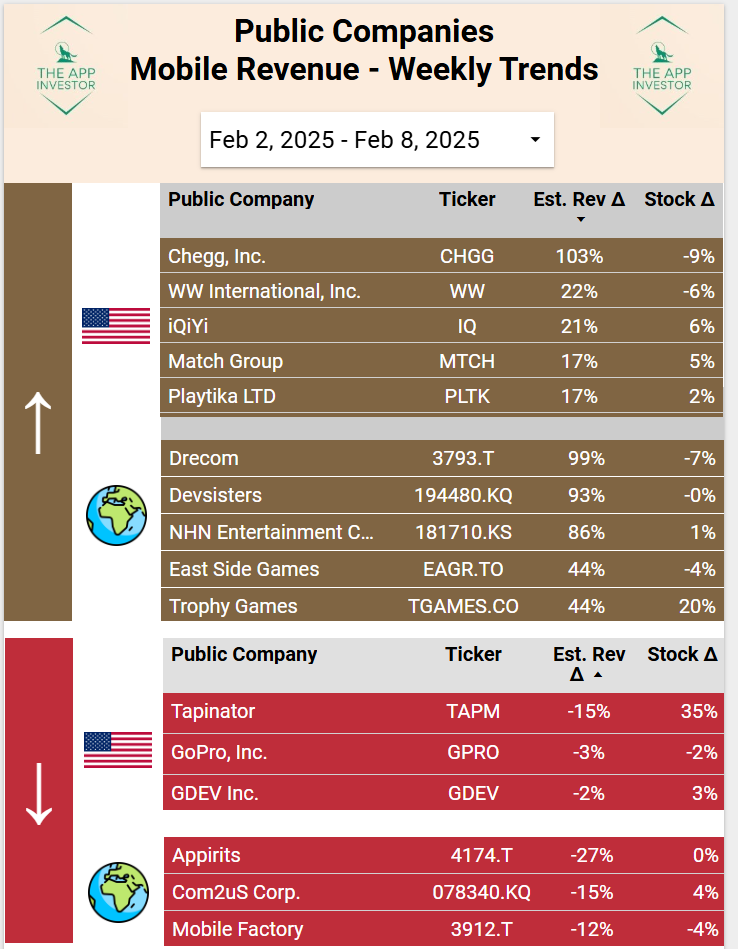

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World)

Losers (US/World)

Our Picks and Watchlist (Gravity, Drecom +Gala Technology Feiyu, Qingci)

Winners this week

US-traded

Chegg (CHGG) is again on the top spot for US traded stock, 3rd in a row? We mentioned 2 weeks ago why we skip them, they had a poor winter so far and they’re just back to baseline.

Other companies on the top list do not impress with less than 25% increase in est. revenue, no catalyst this week.

Worldwide Markets

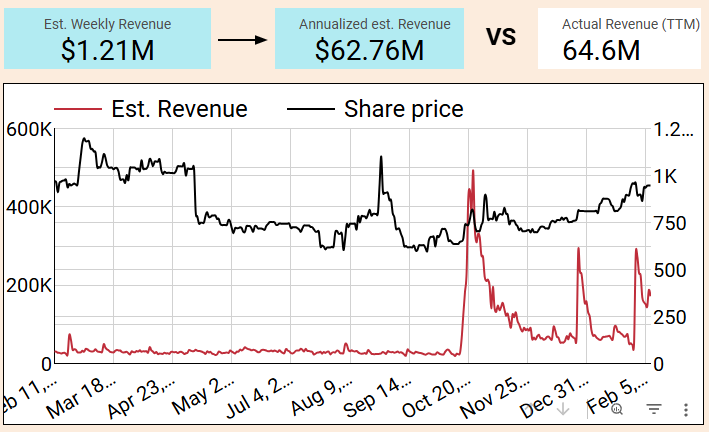

Drecom (3793.T) stole #1 spot from Devsisters (#2) this week! Look at the revenue (red) pattern breaking, this is real positive on their side, demonstrating they can run live Ops on their Wizardry game (no new launch!)

That’s a beauty, and confirms the catalyst. They just recorded a QoQ of > 100% as per earnings release, if you haven’t been following.

We think Drecom has still some legs to go, let’s see if the market agrees next week. Good balance sheet, return to profitability, and a stock rally over the past 2 months - feels good to be a shareholder!

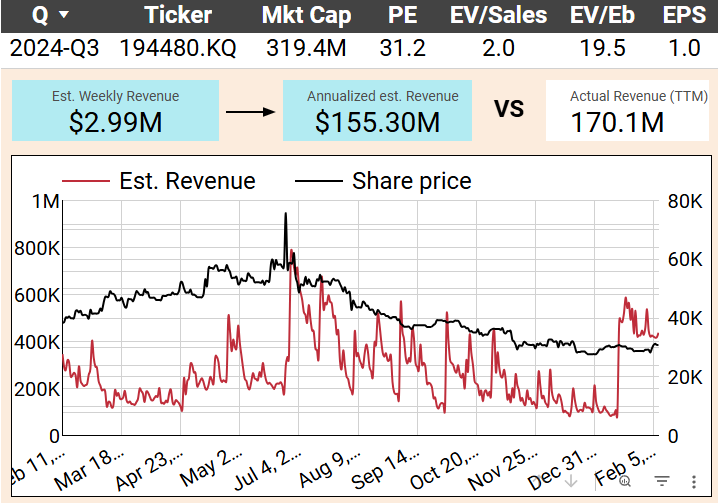

Devsisters (194480.KQ) is also seemingly breaking out from usual patterns for 2 weeks in a row:

The increase is still driven by CookieRun: Kingdom, which suggest this is not a fleeting spike anymore. If you look at past months, this does seem to be more significant.

We do not invest in Korea, but if you are able to, you should take a deeper look, because the market has not reacted yet and it’s sitting at 52W lows.

NHN Entertainment Corporation (181710.KS) is drawing attention with an estimated 86% weekly revenue growth, adding $1.6M to its mobile app figures. This spike, if annualized, could contribute $85M, modestly impacting its $1.8B TTM revenue, yet it's a noteworthy 5% jump. The surge is largely due to mobile apps like "한게임포커 클래식" [Hangame Poker Classic], up 241% with a $751K increase, and "한게임 섯다&맞고" [Hangame Seotda & Matgo], climbing 195% with an extra $598K.

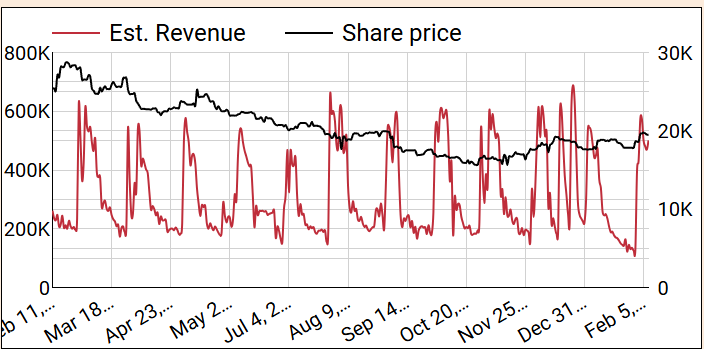

A quick glimpse at the chart though shows that there’s a long-standing pattern with NHN and this is not of interest.

East Side Games (EAGR.TO) is experiencing an estimated 44% bump in weekly revenue, translating to a potential annualized increase of $5.0M, or 8% of its trailing twelve months (TTM) revenue. Key contributors to this surge include "Trailer Park Boys: Greasy Money," which recently launched 23 days ago, boasting a 339% revenue spike, and "RuPaul's Drag Race Superstar," with a 70% rise. However it’s not really significant when looking at the standard deviation, at least not for now.

Loosers this week

Nothing worth worrying about for the ones in the list. They’re not majorly mobile players.

Ongoing Picks - Watch list

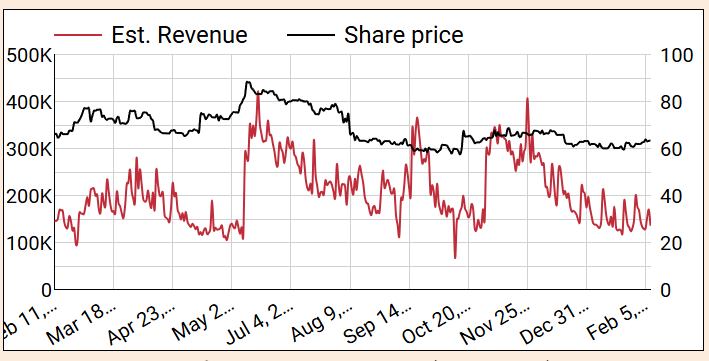

Gravity (GRVY) - Given they have their earnings release coming up next week, here are some quick data points without too much analysis for Gravity.

This quarter will not be record breaking, and unknowing investors may not like the YoY comparison between the full FY2024 and FY2023, given how Origin SEA drove unsustainable growth in 2023. Still, 2024 will come out better than 2022 and the overall picture remains one of stable growth and ultra cheap valuation.

All in all, it seems Q4 will be quite close to Q3.

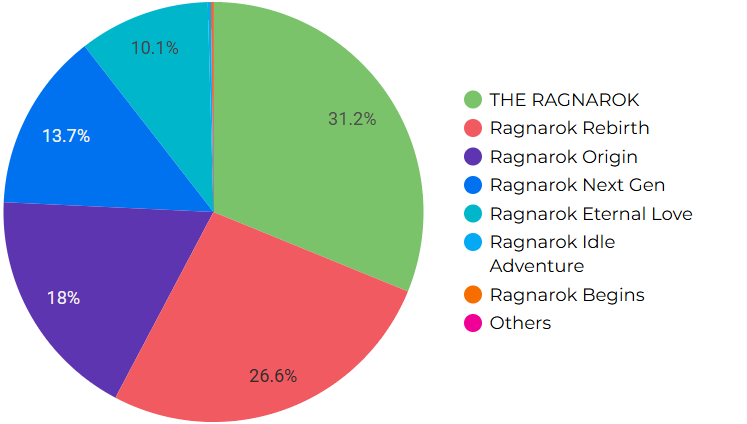

In Q4, revenue has fluctuated largely due to releases of THE RAGNAROK and Rebirth.

Those 2 games were successes, but closer to what Next Gen has been, and clearly not as popular as Origin, who is still in the picture. This is our est. breakdown revenue per game for Q4:

Others:

Qingci (6633.HK), Gala Technology (2458.HK), Feiyu (1022.HK) - nothing to declare, no significant mobile launches.