Mobile revenue roundup - Week 4 2025

Devsisters (194480.KQ) and Mighty Kingdom (MKL.AX)'s momentum accelerate, whilst Drecom (3793.T) about to release their biggest quarter in a very long time

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World)

Losers (US/World)

Our Picks and Watchlist (Gravity, Drecom +Gala Technology Feiyu, Qingci)

Winners this week

US-traded

We' are finding a few usual suspects in top 5 this week. Let’s review Chegg and Weight Watchers (which is here for 3 weeks in a row now). We skip Tapinator (TAPM) given its such small revenue (and market cap) and so volatile. that we would need to see > 300% increase in est. revenue before looking into it.

Chegg (CHGG) is a software company operating a direct-to-student learning platform, which is available on mobile. Its stock is down 85% over the last year, as their business has been VASTLY impacted with the fast advance and rise of LLMs, which are incredible tutors.

Looking at the graph, last week was the highest est. revenue in over a year for their mobile apps - but the +164% vs past 7 weeks is also a reflect of a downtrend in their revenue in the past few months. See for yourself:

Also, it is clearly a tiny fraction of their total revenue, so we’ll be skipping Chegg in the future, except if we see incredibly significant increases.

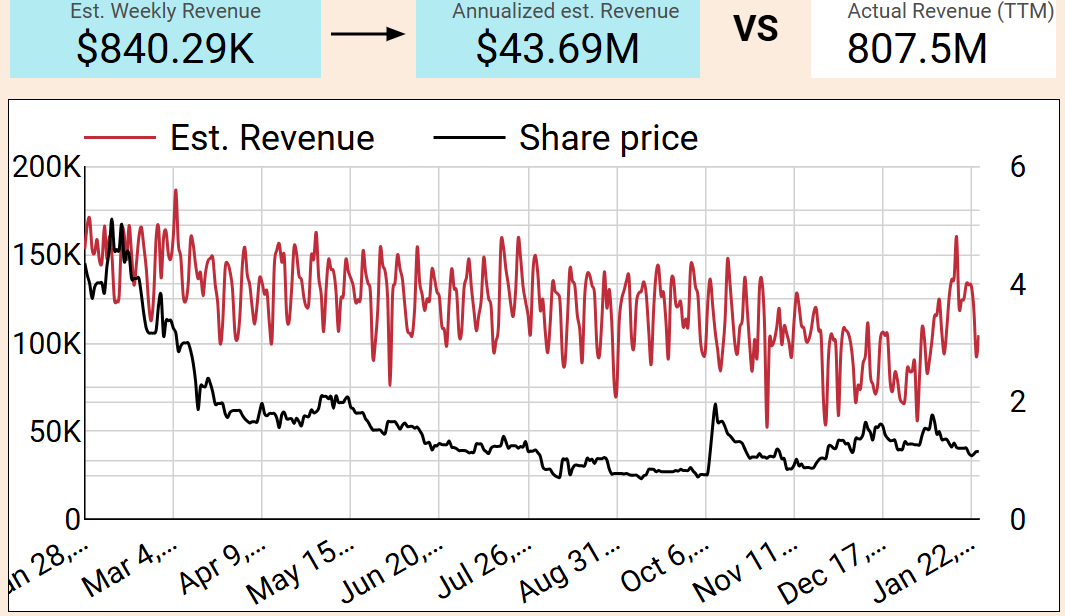

WW International (WW), or Weight Watchers, is back top on the list for a 3rd time now. Mobile is only a fraction of their revenue, but could be indicative of how the overall business is going.

Just like Chegg, what we’re seeing here is rather a reversal of a downtrend than a real uptrend, cf chart:

Hardly the big catalyst we’re searching for.

Worldwide Markets

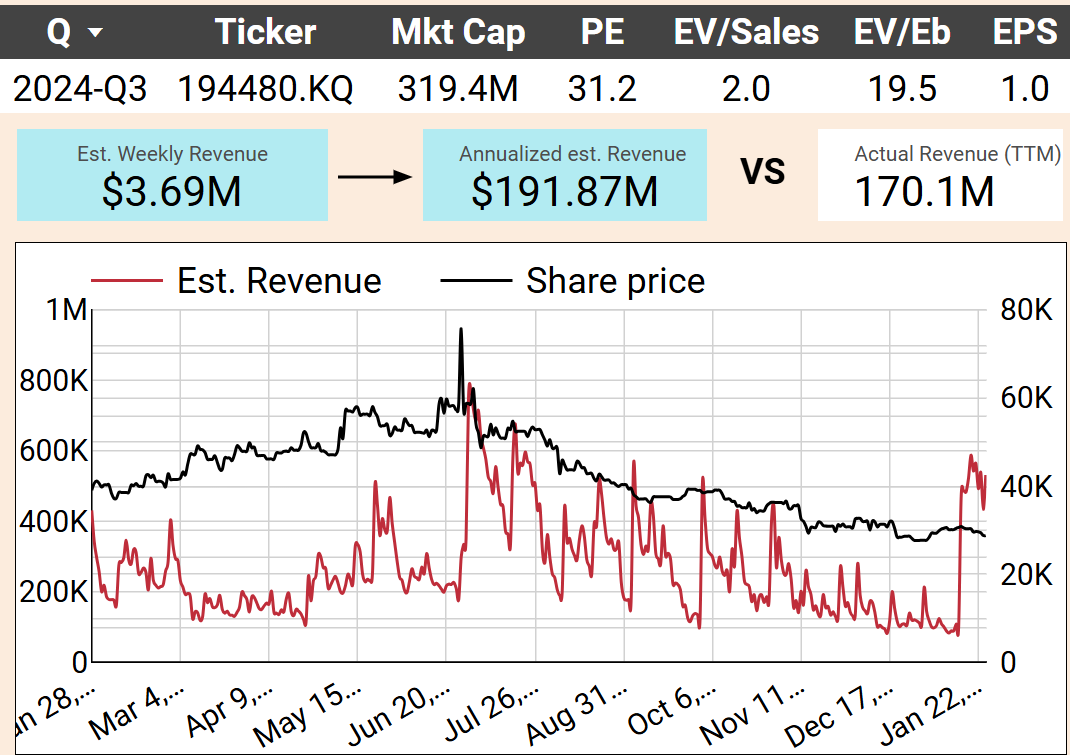

Devsisters (194480.KQ) is back #1 worldwide in est. revenue increase at +287%, meaning their revenue are accelerating even more than last week!

Again, that’s powered by "CookieRun: Kingdom," which by itself added $2.8M in est. revenue!

If this is sustained in the medium-term, that could be a major trend and catalyst for them, given they are a mobile-first video game company. So that is their bread winner.

Looking at the chart - we may may be proven wrong and this could be the start of an anomaly for Devsisters. Too soon to call it, let’s meet again in a week.

Mighty Kingdom (MKL.AX) was already in the top 5 the previous week too. A general warning is that this is a tiny market cap (< $1M), so put a big warning sign on it.

Last week, their estimated revenue grew 80%, accelerating from the previous week, again thanks to Soul Knight. Annualize last week, and that’s an est. $5.5M in revenue, more than their TTM of $3.3M. Significant.

We would also mention that we tend to be on the conservative side for the companies in the lower ranking, but have a good history of identifying revenue increases there too.

Too early to call as well - but if it keeps on accelerating, we’d be looking into it some more.

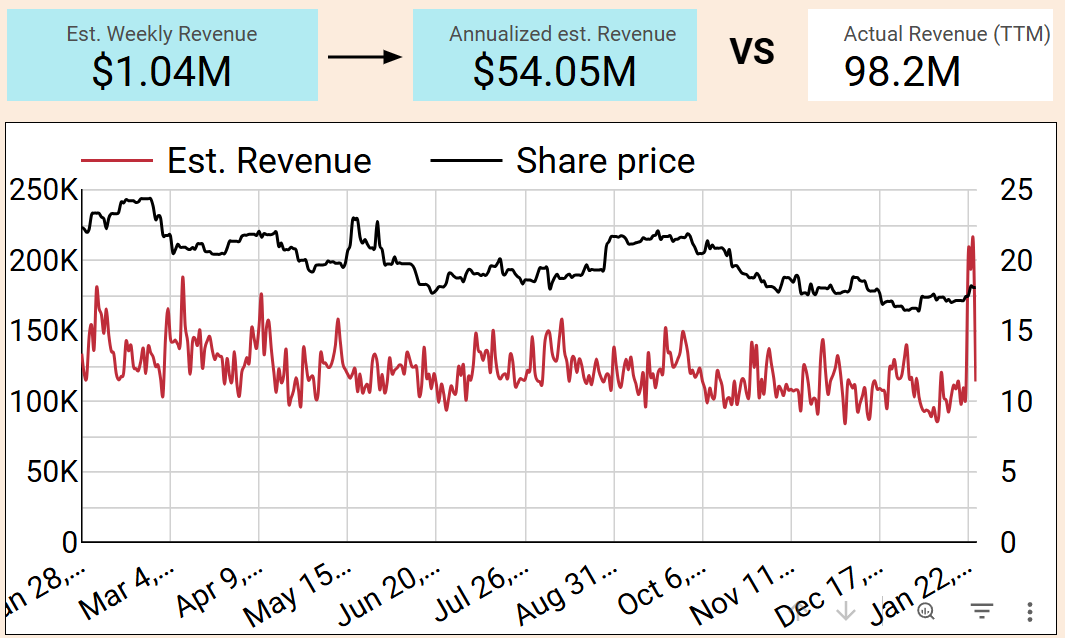

Ten Square Games (TEN on WSE, or 1HQ.F) is a Polish video game company, whose mobile games “Hunting Clash” and “Fishing Clash” are worldwide successes. They have had an interesting +59% break in est. mobile revenue last week, above anything we’ve seen in the past year:

Annualize that increase, that’s 20% of their TTM revenue. However as you can see from the red line, that seems to be short-lived and unlikely to be a trend. Not a catalyst. If it were, we’d be happy to dig in, it’s a strong mobile gaming company.

We like to see Archosaur (9990.HK) in the list, because we have a speculative amount invested in them. However this 48% was not even flagged by our more robust anomaly detection models… because there’s nothing abnormal about it, see for yourselves:

Loosers this week

Again, no relevant companies in that bucket again this week. It’s almost odd, will need to make sure there’s no bug in our pipeline.

KLab is not worth looking at with -31%, their mobile revenue are highly volatile.

Ongoing Picks - Watch list

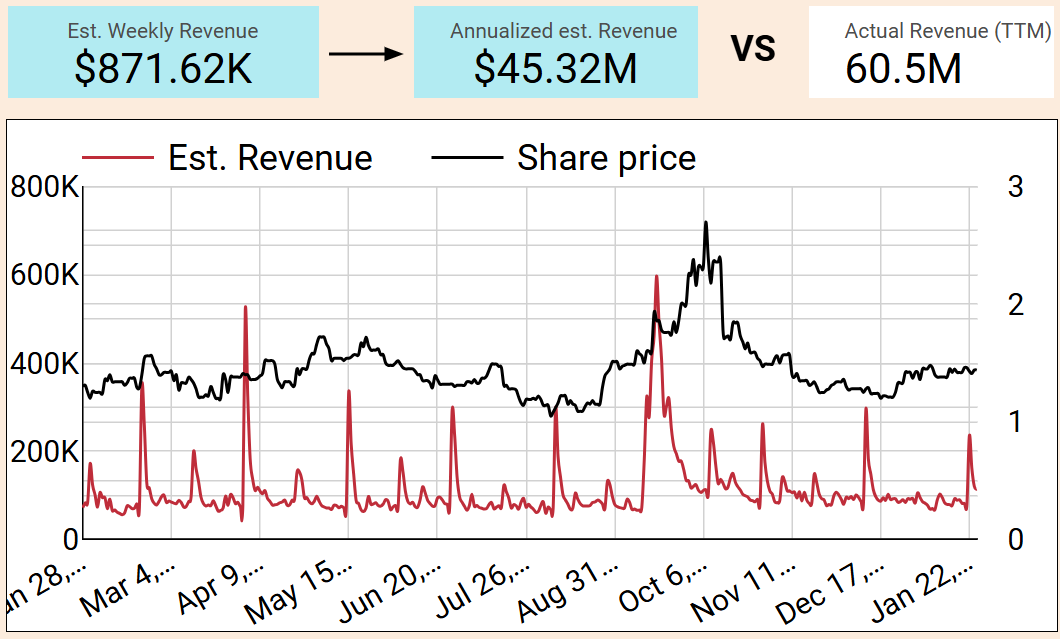

Drecom (3793.T) is very likely to report earnings this week.

It remains our favorite momentum trade in the short term, thanks to Wizardy Variants Daphne ‘s very successful launch and decent live operations. It appears they really have upped their revenue baseline by 2 to 3x.

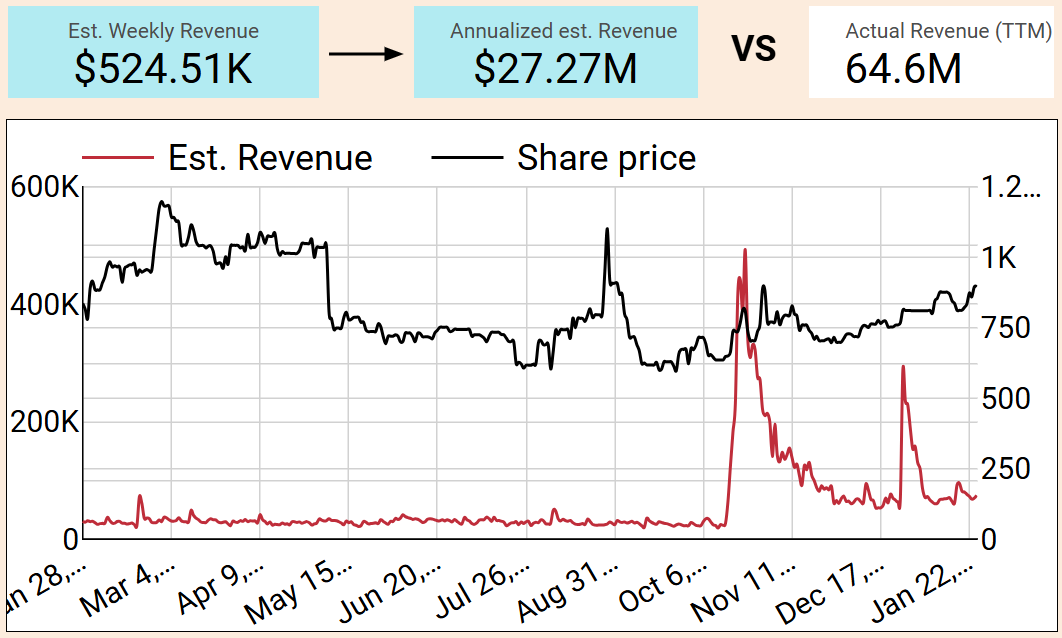

The stock is up 38% since we spotted the anomaly in revenue on Oct 16th 2024 (see that big red spike? that’d be it), further demonstrating the importance of using mobile app ranks at scale to identify trends that may impact markets.

Give a follow on Bluesky or X as we’ll surely summarize the earnings once report is out.

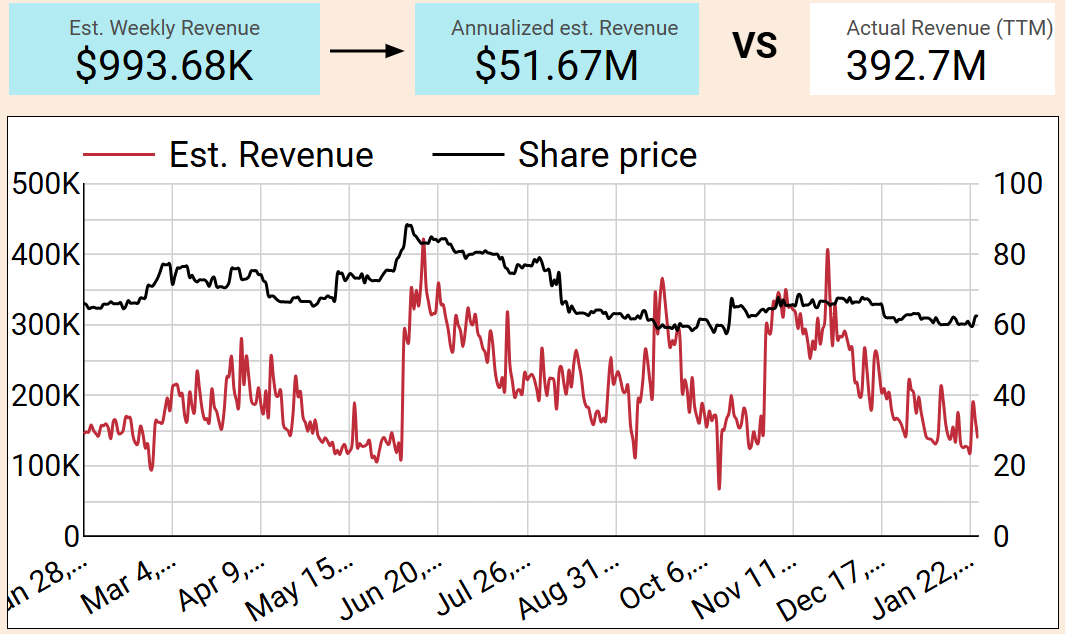

Gravity (GRVY)’s earnings are also close. Without going into a full review, Q4 looks very similar to Q3 in terms of their apps grossing, so we would expect similar results.

Whilst Q4 started strong with both THE RAGNAROK and Ragnarok: Rebirth launching successful across different regions, those games are now at their ‘live ops’ pace. For Q1’2025 to be a growth quarter, they will need to push some fresh new games successfully. That’s their business model.Gala Technology (2458.HK), Feiyu (1022.HK), Qingci (6633.HK) are all roughly stable, slightly downward trend given there has been no significant release in the past 2 months. The usual.