Mobile revenue roundup - Week 3 2025

Weight Watchers (WW) momentum increases, and Mighty Kingdom, of one the smallest publicly traded cap in the industry, shines thanks to Soul Knight.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

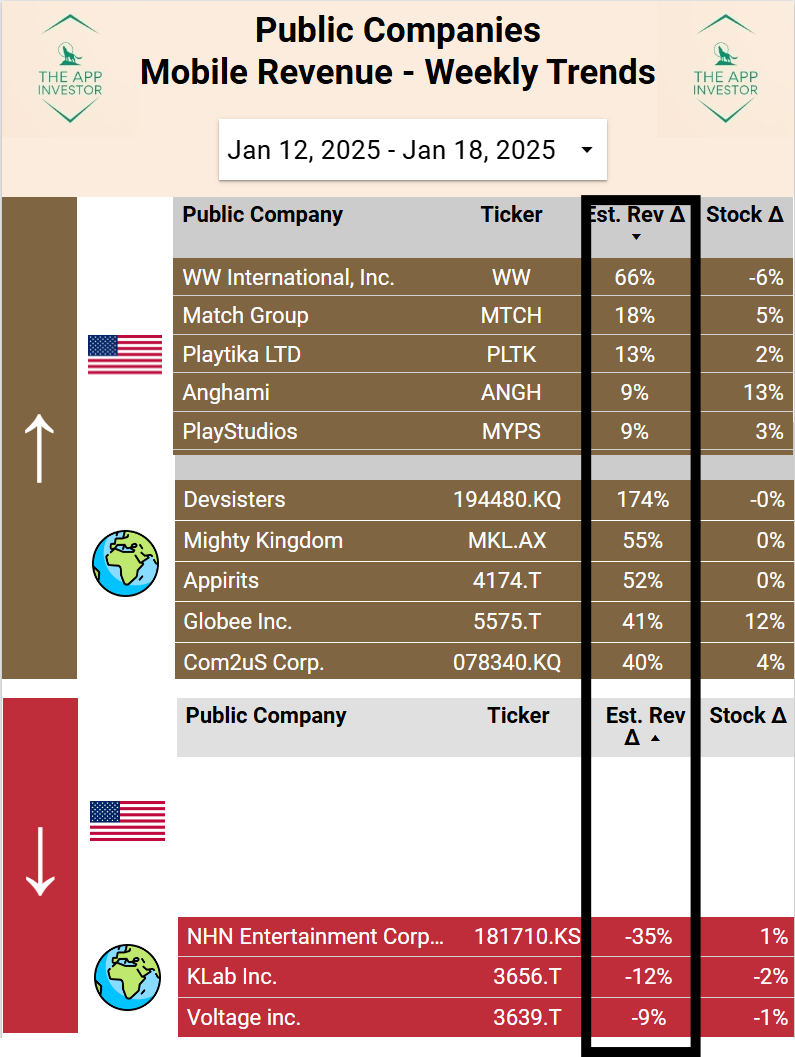

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners

Losers

Our Picks and Watchlist (Drecom, Gala Technology, + Gravity. Feiyu, Qingci)

Winners this week

US-traded

With the end of the year promotion season, GoPro expectedly disappeared from the list.

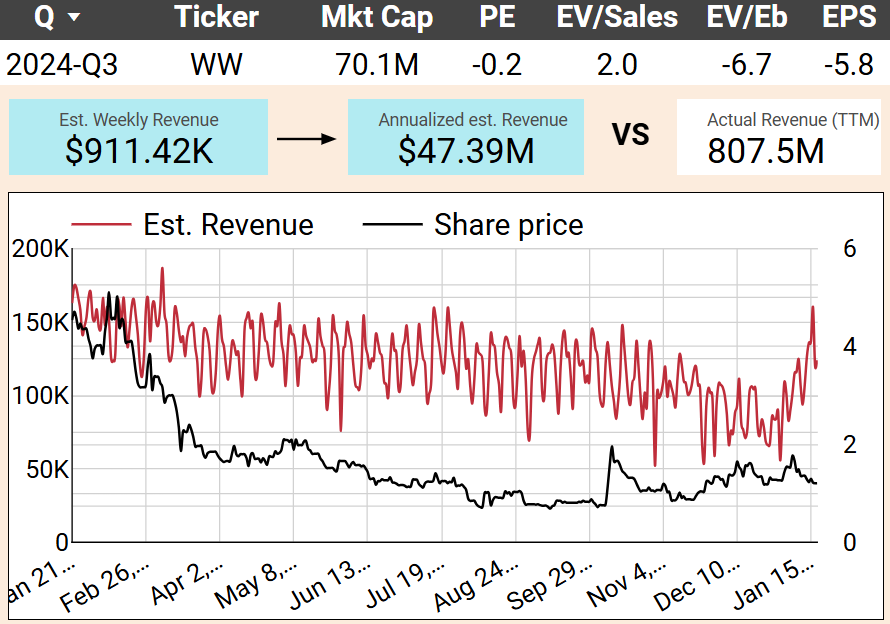

WW International, Inc. (WW), or Weight Watchers, is back top of the list for the 2nd week in a row, with a 66% est. revenue increase vs 7 weeks average. That’s approx. $19M a year if they keep the momentum, a modest impact vs their TTM revenue.

Worldwide Markets

All new line up this week again.

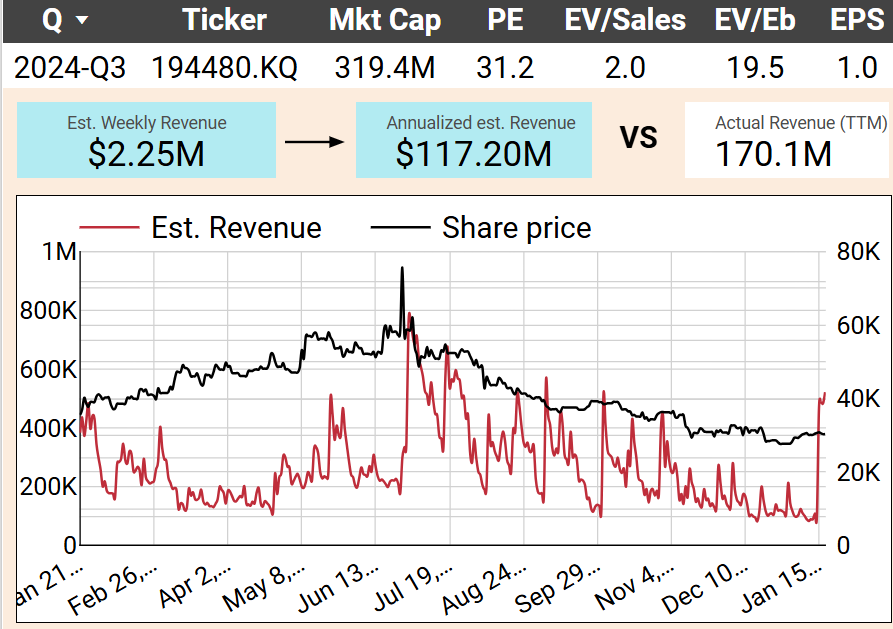

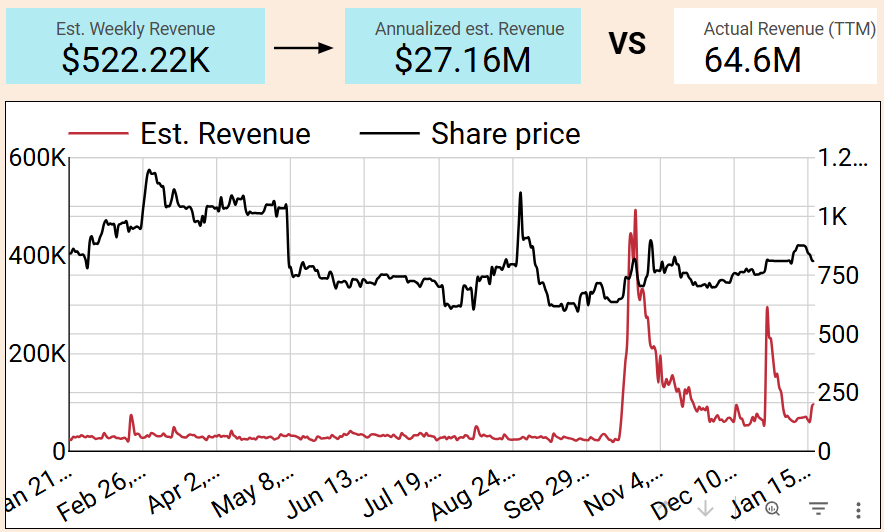

Devsisters (194480.KQ) is experiencing a hugeestimated revenue bump of 174% this week, translating into an annualized increase that could be a catalyst, given its 44% significance against TTM revenue!

That’s thanks to "CookieRun: Kingdom," which saw a revenue surge of 355%, contributing $1.5M to the uplift.

This is a major leap, which leans on a broader trend of fluctuating revenue since mid-2024.

A warning to the trigger-happy investors, this happens regularly with Devsisters and is likely due to a good update or some marketing push, cf. chart.

We don’t think there’s a longer trend to it.

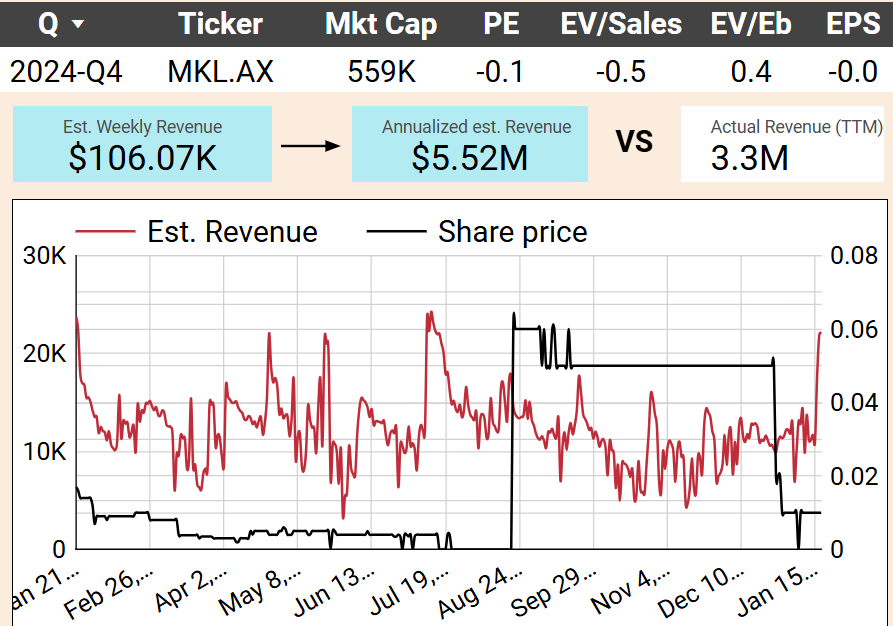

Mighty Kingdom (MKL.AX) is one of the tiniest traded stock out there, with a market cap below US $1M. You’ve been warned.

Last week, their estimated revenue grew 55% this week, adding $38K to their coffers. When annualized, this growth could signify a 59% boost against their trailing twelve-month revenue of $3.3M. First time in about 6 months we saw something as significant for them:

This is driven by a better performance from "Soul Knight," which saw an 83% surge in revenue, and also happens to be their biggest game per revenue on mobile. If this is the start of a long term trend, it’s a real catalyst. Most likely it is not, though.

Appirits and Globee are not worth showing the charts, those 40-50% increase fall right into their standard deviation.

Loosers this week

No relevant companies in that bucket this week. Public companies have been doing well on mobile lately.

Ongoing Picks - Watch list

Drecom (3793.T) remains our highest interest stock in the short term.Wizardy Variants Daphne keeps hitting the mark, even if last week the market wasn’t good to their stock.

Look at the baseline est. revenue before the end of Oct. launch, and after. They’ve got a significant quarter update coming up and we’re in for it.

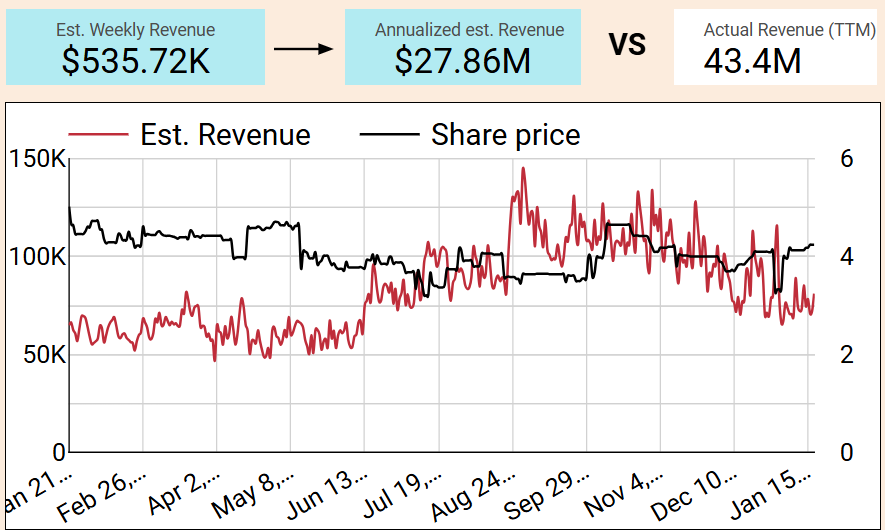

Gala Technology (2458.HK) has been loosing a little bit of their steam, but not enough to worry us as investors. They’re still on a general growth paths vs the first half of 2024, whilst the stock is down from that period.

Given they’re profitable and are likely to pay a dividend in 2025 again, we’re happy to hold our $3.70 haul.

Gravity (GRVY), Feiyu (1022.HK), Qingci (6633.HK) are all roughly stable, slightly downward trend given there has been no significant release in the past 2 months. The usual.