Mobile revenue roundup - Week 22, 2025

Gravity (GRVY) revenue share from non-Asian country increases with Next Gen out globally, and 7Road (0797.HK) comes out swinging with a new mobile hit.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Trending Up

Trending Down

Our Picks and Watchlist

Trending Up this week

US-traded

Gravity Interactive (GRVY) is #1 for US-traded companies in revenue increase for a 7th week in a row (see all mentions of Gravity this sub).

We mentioned both Ragnarok M: Classic and now Ragnarok: Idle Adventure Plus doing well in Taiwan and Hong Kong as the #1 and #2 reason last week.

This week, we’re also seeing that Ragnarok Next Generation, which was released “globally” 2 weeks ago (globally for Gravity = outside of Asia basically), is performing decently well in Brazil (Top 150, not a surprise!), Canada (top 200 grossing), and even the US (top 300 grossing).

To be clear, this isn’t a game changer, but we haven’t really seen good revenue like this from north American markets in a long time, so this is rather positive when it comes to IP building. Next Gen has been out for a long time, probably over 4 years ago? in Taiwan / Hong Kong first and then across Asia, even in China.

It’ll be hard for GRVY to keep this up much longer and we fully expected daily revenue to slowly go down - until the next successful release that is. With a 2025 packed of releases, that’ll likely be in Q3.

Worldwide Markets

7Road (0797.HK) is Chinese online game developer and publisher, best known for titles like DDTank and Wartune. Last week, they released 龍之谷:經典再現 (“Dragon Nest: Classic Reappearance” says Google translate) in Taiwan and Hong Kong where the game hit the top 5-10 grossing.

We haven’t seen successes like that from their mobile division since 2022, and the stock was probably 8x today’s value, so that is definitely a development we will be following closely in the days and weeks to come.

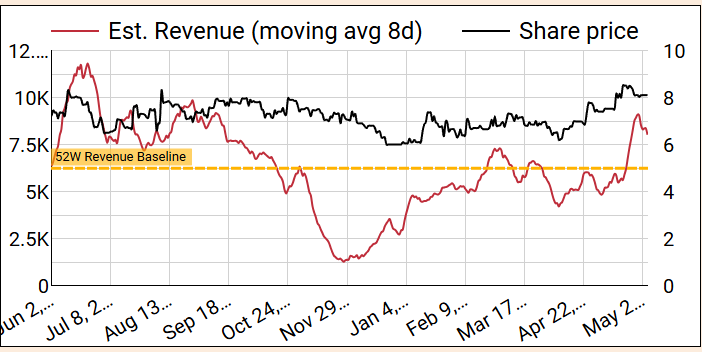

As highlighted above the chart - last week’s mobile estimated revenue was > $500K which annualizes at about $27M. Compared to $42M reported TTM revenue, it could be quite significant. And that all happened mid-next last week, if we look et the daily chart, we’re at about 5x the 52 weeks baseline revenue for mobile!

It is also encouraging that this happens with revenue in Taiwan and Hong Kong, which are large markets but dwarfed by China - so there is much more to tap.

We’ll be diving deeper into 7Road if we see that this trend continues.

Archosaur Games (9990.HK) shows up for a 2nd week in a row in the top 5. Looking at the chart, their revenue increase is hardly significant and is clearly a pattern, likely game operations / regular updates.

Nothing to dive in here.

Trophy Games (TGAMES.CO) doesn’t appear in the top 5 this week but we wanted to follow up after last week. They had a decent week vs baseline but so far it’s still very weak signal in terms of revenue growth. Not strong enough for us to look into it.

We looked at Aiming (3911.T), GungHo (3765.T) and Mobirix - and the variance in their revenue is not worth a look for now - just standard deviation.

Ongoing Picks - Watch list

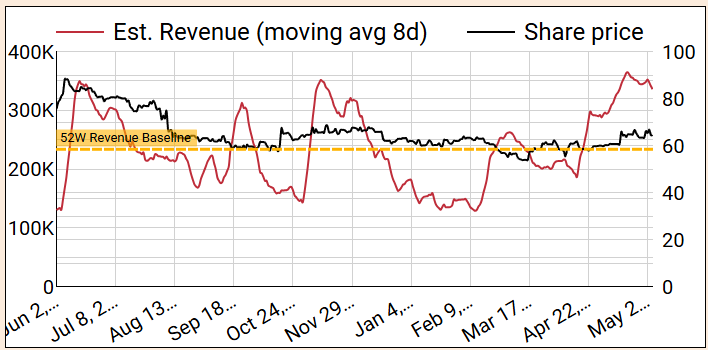

Feiyu (1022.HK) is still around and kicking above baseline for 2 whole months now, albeit a slightly slower last week:

We hold our share and do not consider the last 2 months movement a significant enough catalyst to buy more.

Drecom (3793.T), Gala Technology (2458.HK) and Qingci Games (6633.HK) - No update worth covering, we’re holding onto our shares. Particularly bullish about Drecom’s prospects and turnaround still. We covered them in the past, search for tthose articles if you invest in Japan!