Mobile revenue roundup - Week 5 2025

Drecom (Japan)'s sustained success drives >100% increase QoQ revenue, and a potential catalyst with Devsisters (Korea)

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

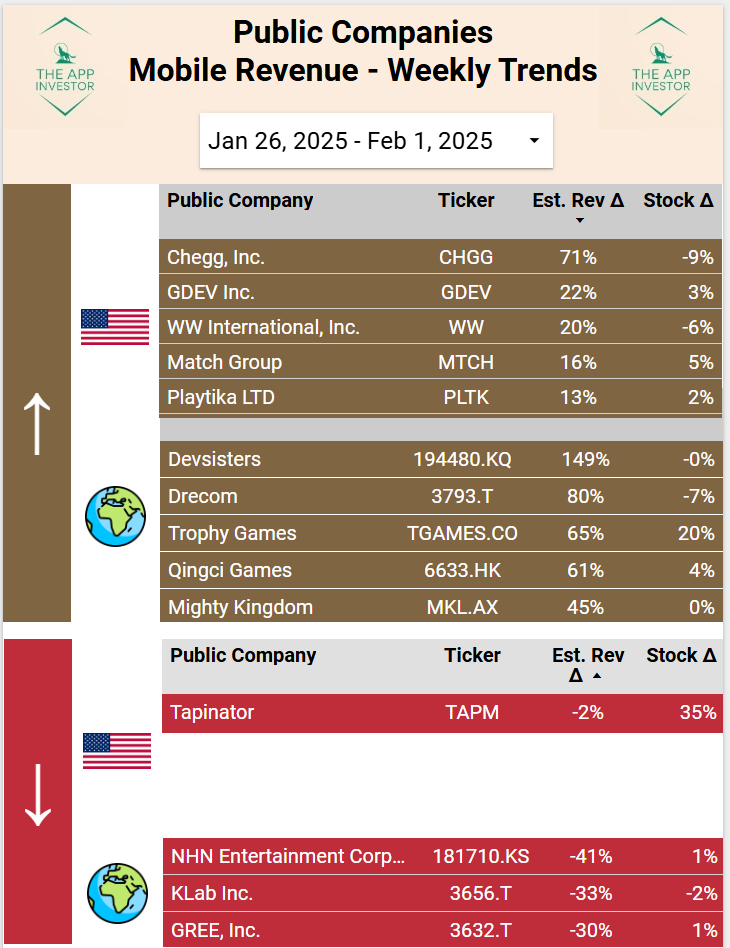

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World)

Losers (US/World)

Our Picks and Watchlist (Gravity, Drecom +Gala Technology Feiyu, Qingci)

Winners this week

US-traded

Chegg (CHGG) is again on the top spot for US traded stock. We mentioned last week why we skip them.

Other companies on the top list do not impress with less than 25% increase in est. revenue, no catalyst this week.

Worldwide Markets

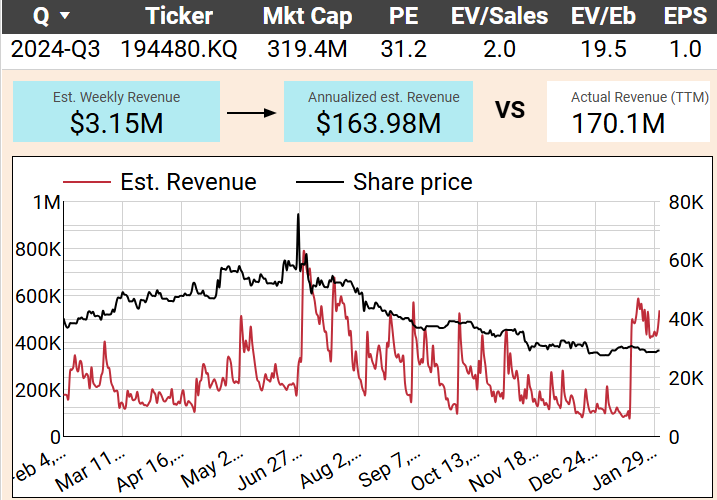

Devsisters (194480.KQ) again #1 worldwide in est. revenue increase at +149%.

Let’s pull the est. revenue graph directly:

This is new in that usual its revenue would falter after a peak, likely due to a new update and in-app package.

Given that this increase is still driven by CookieRun: Kingdom, which alone added an estimated $1.9M, and not a new game, we’d wait a bit more before calling this a real momentum. However it’s significant compared to past movements.

Confidence level is higher than last week, but it remain too early to call it a catalyst.

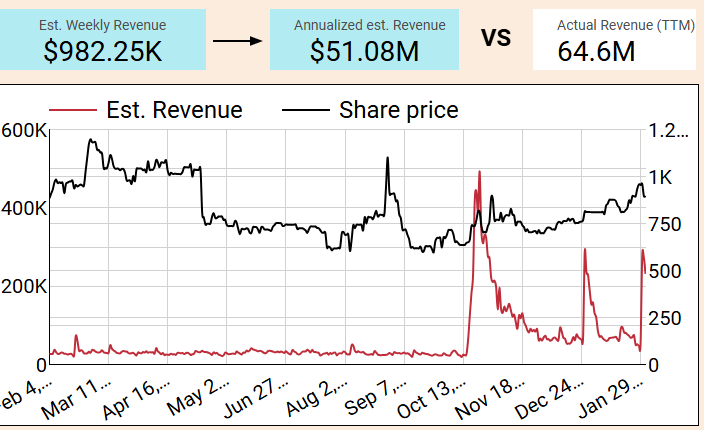

Drecom (3793.T) makes a showing at a +80% revenue last week vs past 7 weeks. Pulling the chart, it seems to be the live ops of Wizardry Variants Daphne, their big success, and the reason we purchased share of Drecom in November.

Drecom released their earnings last week, and announced > 100% increase in QoQ revenue, and a profitable quarter for the first time in a while. The proof in the pudding of the importance of following app ranks to estimate revenue for mobile developers! The stock is considerably up in the past 3 months, cf black line in above graph.

Given the company was in cost-reduction mode to optimize for profitability, that new hit came at a perfect time. We also think that the Wizardry franchise (that Drecom purchased) is powerful enough in Japan that this could lead to a longer tail of revenue and new hits.

Qingci (6633.HK) is another of our pick list, so we’re always happy to see them making the top 5. That being said, and just like Chegg, it’s rather that they had a weaker beginning of winter. Last week was just a normal week for them.

Loosers this week

Nothing worth worrying about for the ones in the list. They’re not majorly mobile players.

Ongoing Picks - Watch list

Gravity (GRVY) (earnings soon), Gala Technology (2458.HK), Feiyu (1022.HK) - nothing to declare, no significant mobile launches.

Qingci & Drecom covered briefly above.