Mobile revenue roundup - Week 20, 2025

Gravity (GRVY) and Feiyu (1022.HK) momentum continues, and Drecom (3793.T) earnings.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

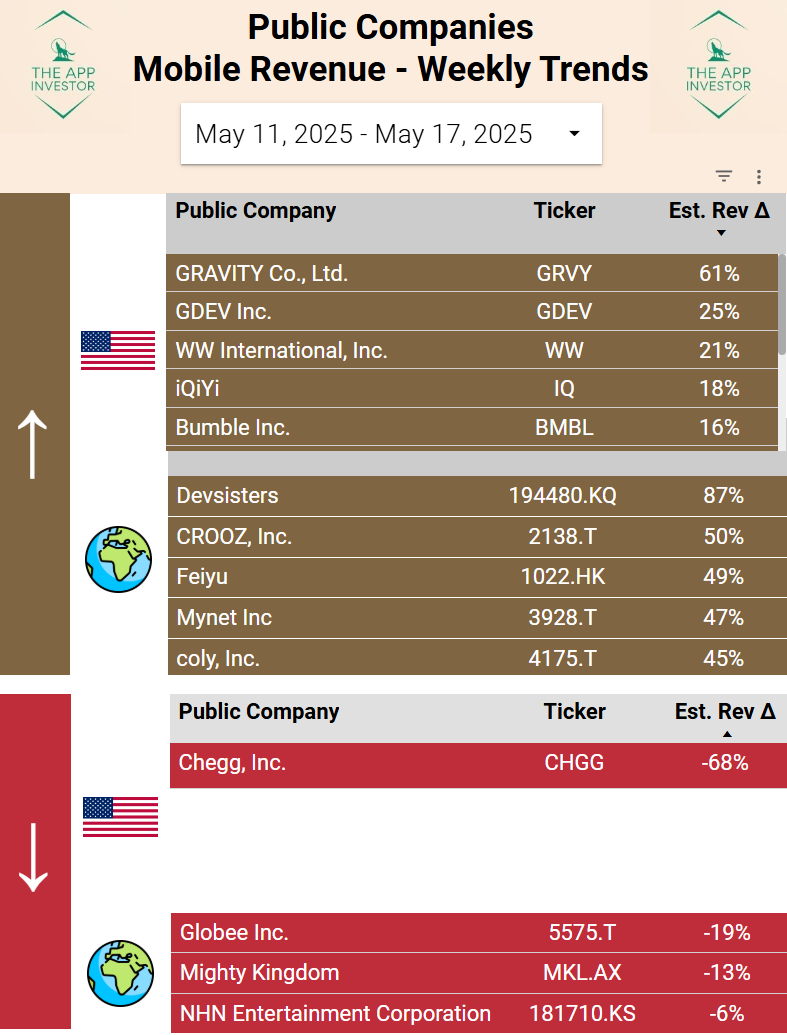

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Trending Up

Trending Down

Our Picks and Watchlist

Trending Up this week

US-traded

Gravity Interactive (GRVY) is #1 for US-traded companies in revenue increase for a 5th week in a row (see all mentions of Gravity this sub). Nothing new here - it’s still Ragnarok M Classic performing well in TW and HK that is driving this momentum.

This is shaping Q2 like the strongest quarter in a while so we’ll be picking up shares in case of dips in the coming months.

Worldwide Markets

Feiyu (1022.HK) has been getting some traction in the past few weeks with the release of a game named “1-Step 2-Steps”, which is driving their revenue about 50% higher than the 52 weeks baseline right now:

Stock has not reacted at all, which isn’t surprising given the company' size ($50M market cap, $38M in revenue TTM) and its lack of analyst coverage. Investors will be notified somewhen in September when they release their 1H for 2025.

We already have a few shares of Feiyu to which we hold on for now.

We dived into the other charts of the top 5 worldwide (Devsisters, CROOZ, Mynet and Coly) - and there was no meaningful trend - just high variability.

Trending down this week

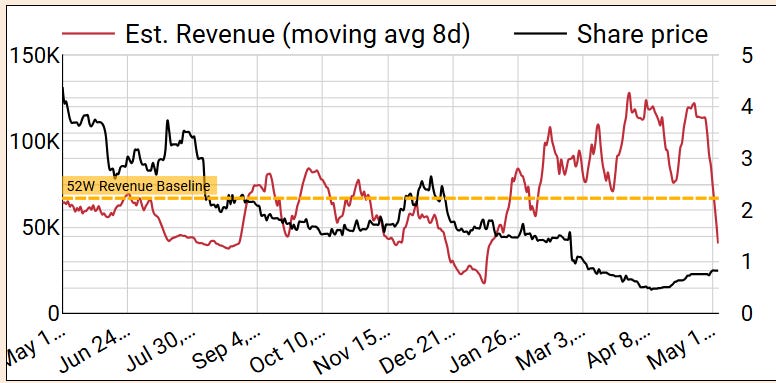

Chegg (CHGG)’s main Homework Help app study suffered a drop in rankings last week. We only cover a fraction of Chegg’s revenue overall (only Chinese iOS store basically) - so this may not be meaningful at all for the business, and it follows weeks of higher-than-usual revenue, cf chart:

Ongoing Picks - Watch list

Drecom (3793.T) announced impressive revenue growth (we told you!!): +108% YoY and +6% QoQ. In short:

Revenue came in higher than we expected - with Wizardry Variatns Daphne being the main revenue driver as we’ve been saying

Profit was lower than we expected, mostly due to Disney STEP tanking profitability. They seem to still spend on user acquisition for this game.

Stock is up about 5% since earnings release, so not a significant hike.

Our conclusion:

If they cannot turn Disney STEP profitable in the next quarter or 2, they should write it off and focus their energy on the other titles. All of them are profitable. In fact, without Disney STEP debacle this would have been a huge quarter on both top and bottom line. Hopefully they learnt a lesson or two from this.

Drecom has a clear path to long-term profitability, which isn’t reflect in its current valuation. We remain bullish on them and are holding a sizable amount of shares.

Gala Technology (2458.HK) and Qingci Games (6633.HK) - No update worth covering.