Mobile revenue roundup - Week 2 2025

WW dropping some weight whilst Neowiz (Korea) momentum is building up in the mobile app market.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners

Losers

Our Picks and Watchlist (Drecom, Gravity, Gala Technology, Feiyu, Qingci)

Winners this week

US-traded

With the end of the year promotion season, GoPro expectedly disappeared from the list.

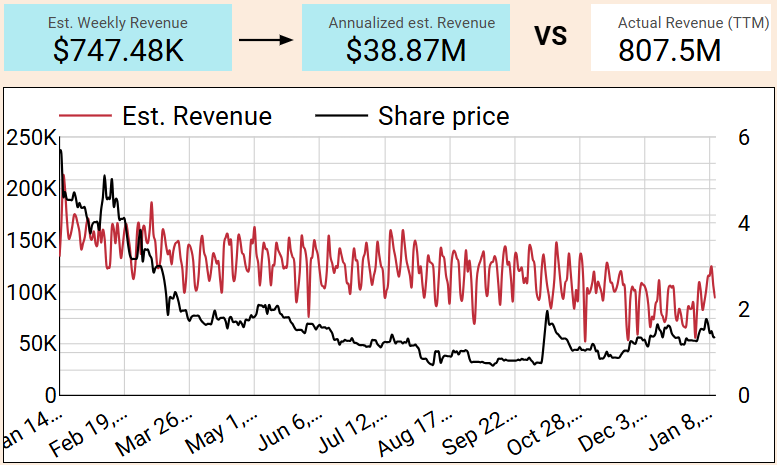

WW International, Inc. (WW), better known as Weight Watchers, has experienced a notable estimated weekly revenue growth of 37%, translating to a $203K bump. This spike is primarily driven by their WeightWatchers Program app, which is seeing a steady trend reversal after a prolonged decline in recent months. Cf. chart, WW’s ranks have been on a steady decline over 2024.

The annualized revenue increase is just 1% of TTM value, so there s no catalyst here. Maybe the start of a resurgence after a few poor months? Time will tell.

Interestingly, WW stock is up 20% in that week. Doubt it’s related.

Worldwide Markets

All new line up this week.

Mynet Inc (3928.T) tops the list with an estimated 58% surge in weekly mobile app revenue vs past 7 weeks, amounting to a $70K increase. If sustained, this could boost annual revenue by $3.6M, a 6% rise compared to its TTM revenue—potentially a valuation catalyst for a company with a $19.1M market cap (with $57M revenue TTM).

The apps driving this growth include

"ジョーカー〜ギャングロード〜マンガRPGxカードゲーム" (Joker Gang Road Manga RPG x Card Game)

"神式一閃 カムライトライブ" (Kami-style One Flash Kamurai Live)

both showing over 4x revenue surges.

Whilst this deviate from a lower than usual December month for them, it’s not looking that significant at this stage, cf. graph below. Pass.

NEOWIZ (095660.KQ) has made regular showings in the top 5 recently, this time with an weekly revenue bump of $326K, translating to a 50% increase vs 7 weeks average. The annualized revenue boost of $17M could subtly shift the valuation needle for a company with a market cap of $324.6M.

Two apps, Pmang Poker: Casino Royal and BrownDust2 - Adventure RPG, are driving this surge with revenue upticks of 123% and 33%, respectively.

Based on the est. daily revenue line, we’d expect the moving average to be going up now, hinting at potential sustained momentum rather than just a blip.

Mixi (2121.T) finishes our review with a weekly estimated revenue growth of 37%, translating to an additional $1.7M in mobile app revenue. If annualized, this could add $88.9M to their top line, about 9% of their TTM revenue—not unsignificant.

However, with no new game out and a looking at their revenue deviation over time, this is not looking like a catalyst either, especially at this valuation.

Loosers this week

No relevant companies in that bucket - marginal.

Ongoing Picks - Watch list

Drecom (3793.T) is one of our favorite stock these days, with theirWizardy Variants Daphne doing well. The stock has also been steadily going up since that the release, a sign of market efficiency?

Whilst Drecom do not seem to successfully keep their game in the top rankings for more than a few days, their baseline of est. mobile revenue remains 2.5x what it was before its launch. We’re looking forward to the earnings end of January, and still hold a good chunk of shares.

Gravity (GRVY), Gala Technology (2458.HK), Feiyu (1022.HK), Qingci (6633.HK): Nothing to see. All stable.