Mobile revenue roundup - Week 18, 2025

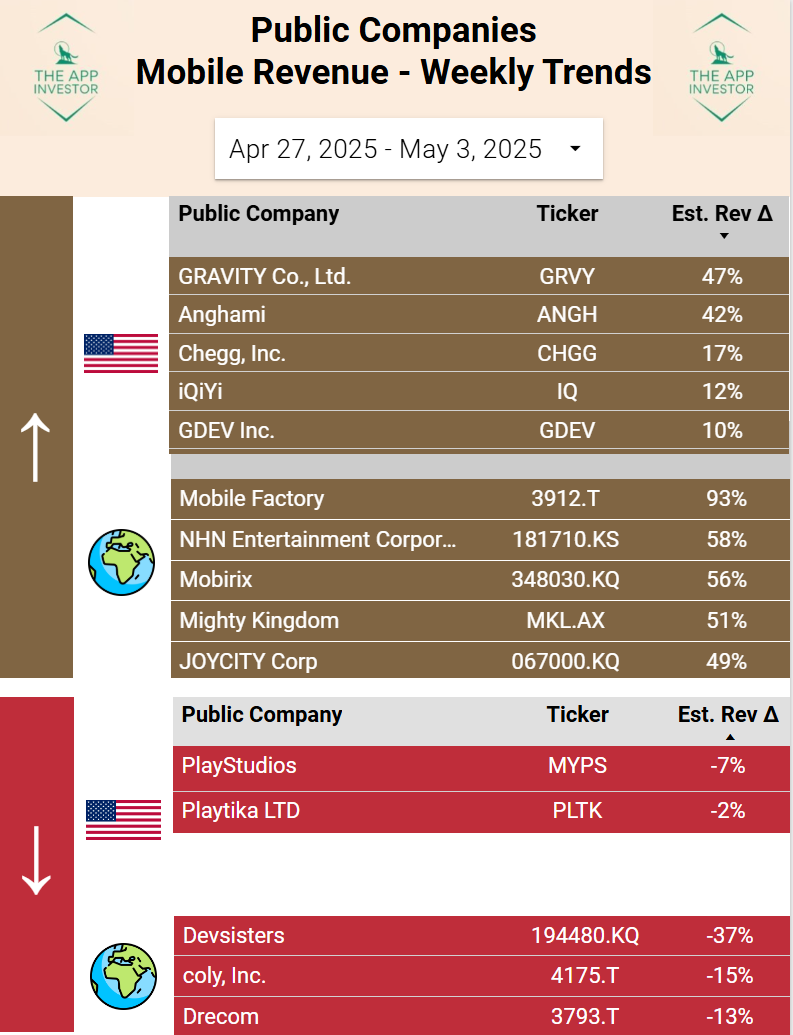

Gravity #1 trending for a 3rd time in a row with Q2 already shaping up better than Q1. Mobile Factory leads the worldwide chart.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners (US/World):

Our Picks and Watchlist

Winners this week

US-traded

Gravity Interactive (GRVY) is #1 for US-traded companies in revenue increase for a 3rd week in a row (see all mentions of Gravity this sub). Last week, we covered a few updates from their newly files full 2024 report.

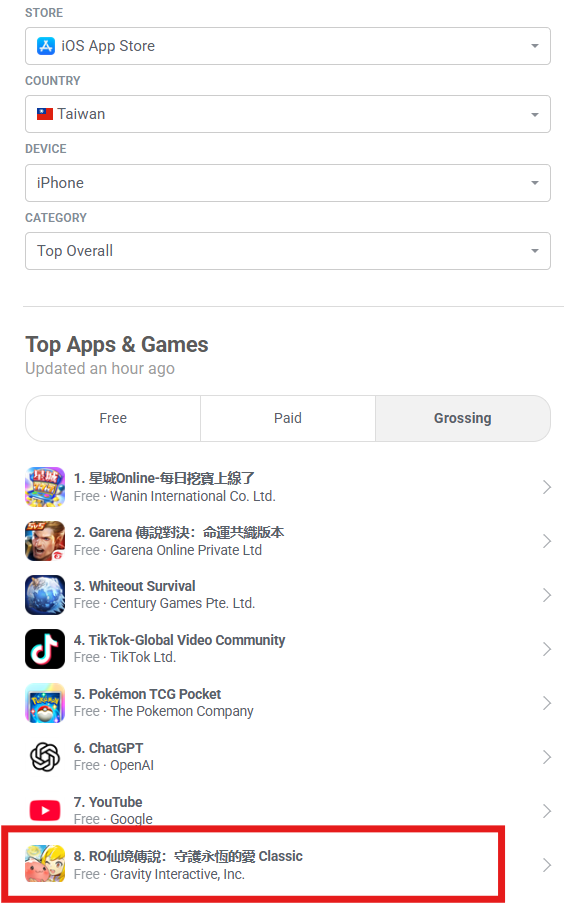

This revenue increase vs baseline is still driven by Ragnarok M Classic performing well in Taiwan in particular. It also follows a slightly more tamed end of Q1 with no major release in March, which explains why we’re seeing close to a +50% revenue variance.

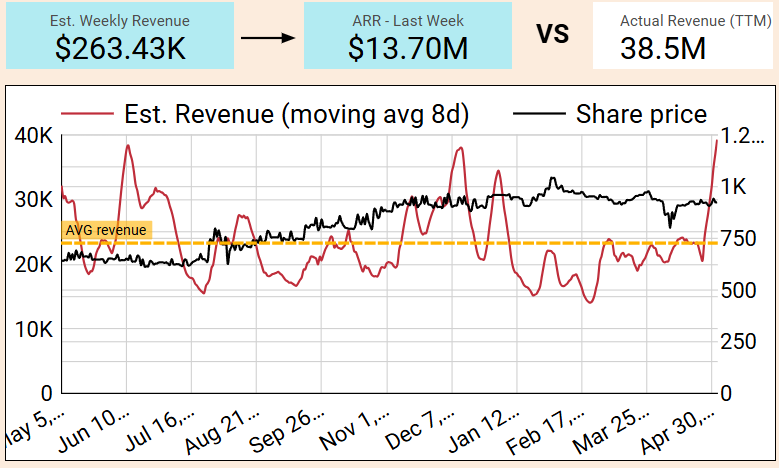

As you can see from the following graph, current revenue pace is higher than the 52W baseline, but we’re not in uncharted territory either.

Gravity revenue generally goes up and down with major release. That being said - M Classic seems to really stick with Taiwanese users and is already shaping up to be a major revenue driver in Q2.

On the topic of quarter.. - Gravity’s earnings release are around the corner, planned for May 9th, this Friday. It’s important to note though, that Q1 was not a great quarter (and it rarely is). Knowing how strong Q2 has started - this may open opportunities on Friday depending on investors reactions.

Anghami (ANGH) +42%, is sometimes qualified as the Middle-Eastern TikTok. The revenue increase looks like a short-lived spike already - we won’t dive any further.

Worldwide Markets

Mobile Factory (3912.T) has seen a notable estimated weekly revenue surge of 93%, translating into a $127K bump. This is no small potatoes, equating to a 17% annualized gain compared to its TTM revenue. This hits the highest we’ve recorded for their est. revenuein the last 52 weeks:

A major player in this rally is their app "駅メモ! - ステーションメモリーズ!- 鉄道位置ゲーム" [Station Memories! - Railway Location Game], which alone accounted for a $121K increase.

The revenue variation is a meaningful deviation from the norm. Much to early to consider this a potential catalyst - but we’ll follow up if the revenue keep increasing.

We dived into the other charts of the top 5 worldwide (NHN, Mobirix, Mighty Kingdom and Joycity) - and they hold no long-term impact, for now.

Ongoing Picks - Watch list

Drecom (3793.T) earnings are in 1 week and as we keep reiterating, we expect a massive blowout of a quarter. It makes no sense to use that the stock is lower today than when they launched Wizardry Variants Daphne, which has been an unexpected major success and is still driving considerably higher revenue.

We’ll be watching out in the call for marketing costs - which is the unknown we worry about.

Globee (5575.T) had been on our radar, showing in the top 5 for a few weeks in a row. We just wanted to close the loop: it’s right now looking like it won’t be able to maintain its revenue jump, and this is likely just a major promotion on their “abceed” app.

Loop closed - for now.

Feiyu (1022.HK), Gala Technology (2458.HK) and Qingci Games (6633.HK) - No update worth covering.