Mobile revenue roundup - Week 1 2025

Drecom surges again with Wizardry Variants Daphne live Ops. Mentions: GoPro, KLab, CyberAgent, BoomBit & GREE.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Content

Winners

Losers

Our Picks and Watchlist (Drecom, Gravity, Gala Technology, Feiyu, Qingci)

Winners this week

US-traded

GoPro, Inc. (GPRO) is back in the top spot for a 2nd week in a row. As previously explained, this is a yearly promotion that gets their revenue up every christmas, and as one can see in the below graph (est. revenue in red), the increase is already fading, as it did every year before. No catalyst here.

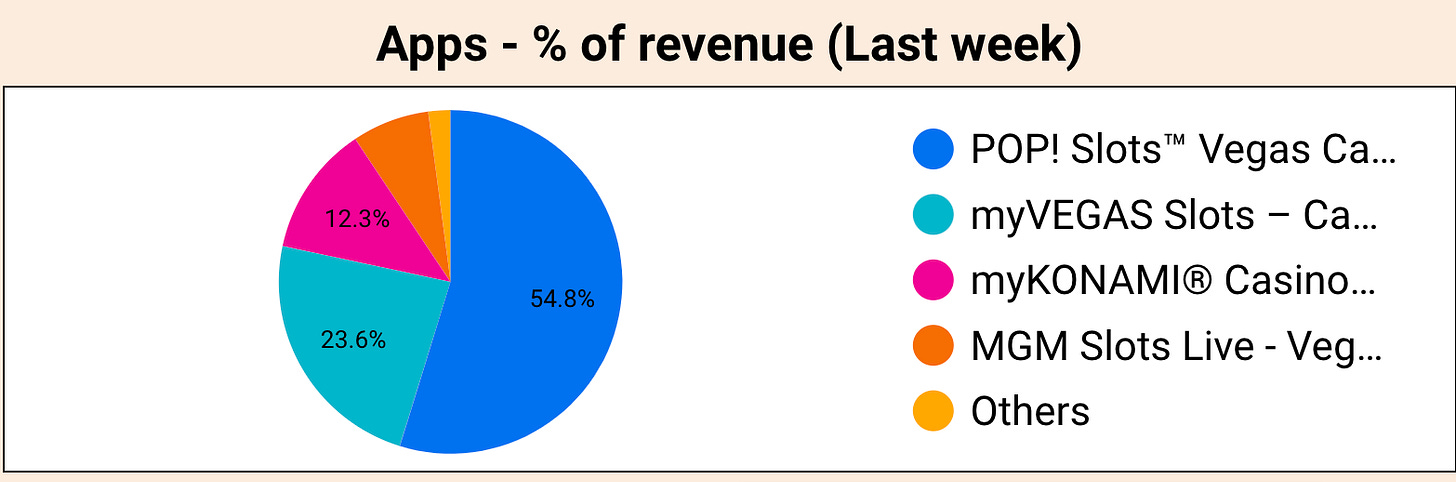

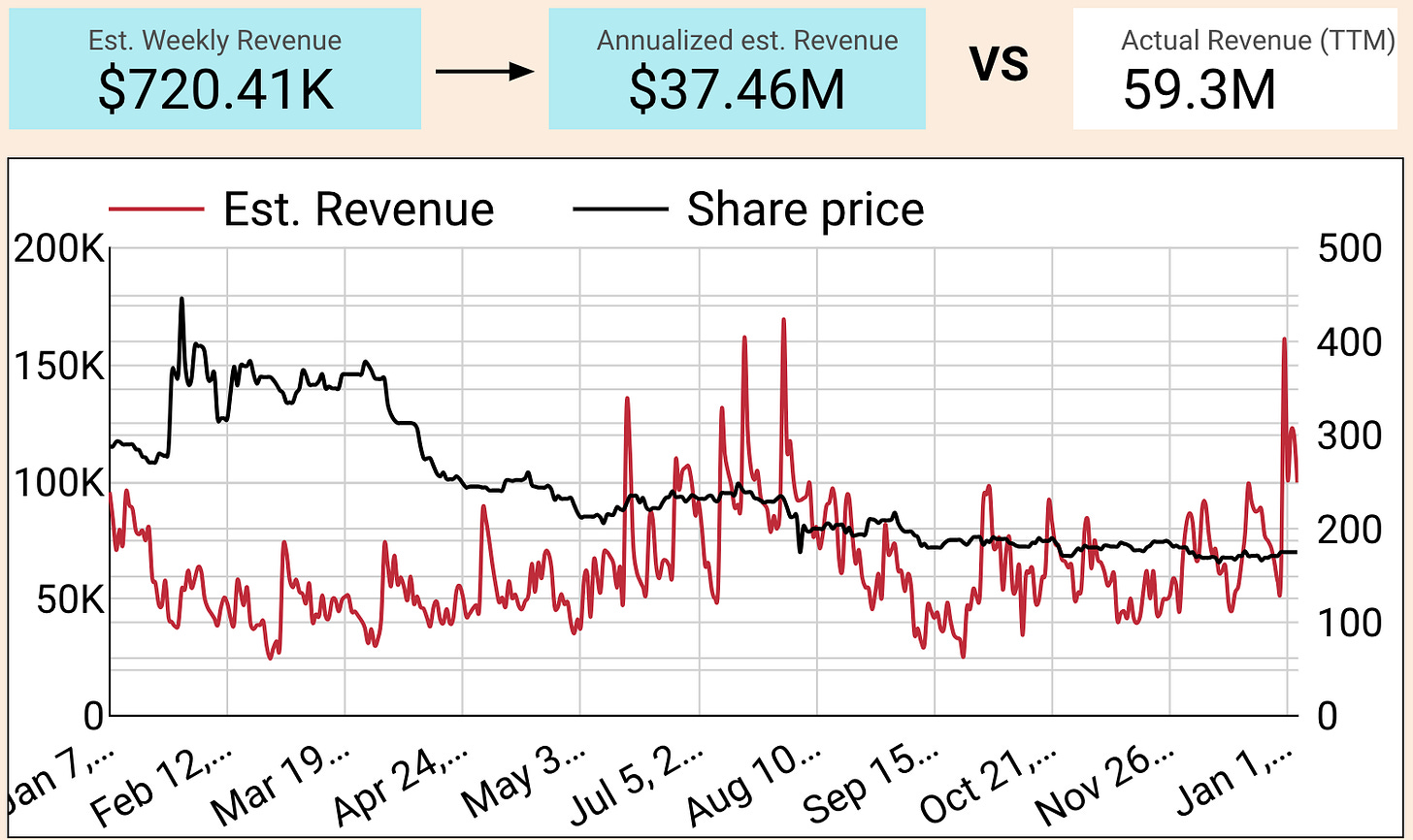

PlayStudios (MYPS) is a mobile app developer focusing on casino-like games. It has shown a notable weekly revenue growth of 20%, or about $400K increase. This uptick is driven by their top app "POP! Slots™ Vegas Casino Games," which alone saw a 24% rise, contributing over $250K.

This revenue variation is not, in fact, too significant, when looking at the longer trend. The stock itself was also up 9% in the same week, which is likely not related.

Worldwide Markets

KLab Inc. (3656.T) has seen an impressive estimated mobile revenue growth of 86% this past week, translating to an est. $333K increase. Annualized, this could add $17.3M to their revenue—about 29% of their TTM revenue—potentially acting as a valuation catalyst.

Notably, "Bleach: Brave Souls Anime Game" spearheaded this surge with a 149% revenue jump, adding over $280K. This spike is highly significant, outpacing standard deviations by a large margin, cf chart below. This is a full year span.

We’ll keep KLab on watch for now, to see whether this trend is sustainable or not. However, we do not think it is. Why? Because that Bleach (japanese popular anime franchise) game has been their #1 bread maker for a long time now, so it’s probably just a popular update / live operations success, which usually drive spikes but not long term trends.

CyberAgent (4751.T) has shown estimated mobile revenue growth of 59% this week, translating into an additional $4.0M. This is really minor compared to their $9.2B TTM revenue.

"グランブルーファンタジー" [Granblue Fantasy] spiked revenue by 364%, contributing $471K

"呪術廻戦 ファントムパレード(ファンパレ)" [Jujutsu Kaisen: Phantom Parade] added $1.3M with a 98% increase.

This is not a significant enough catalyst, and we already see the revenue going down towards the end of the week, cf chart below.

Boombit (BBT.WA) surged with a 58% estimated weekly revenue increase, or a $75K boost, which could be a small but meaningful valuation catalyst. This growth, translating to an annualized $3.8M, marks a 7% rise against its TTM revenue.

"Loot Heroes: Fantasy RPG Games" jumped 417% in revenue 45 days post-launch

"Darts Club: PvP Multiplayer", "Hunt Royale: Action RPG Battle" also significantly contributed.

The revenue spike is not vastly significant compared to its standard deviation, as the chart below will show you.

With an EV/EBITDA of 4.5, BoomBit is always worth a look when revenue is up. We doubt this is a longer term trend, but we’ll keep an eye out.

GREE Inc. (3632.T) has made regular showings in the top 5 recently, this time with a hefty estimated 54% bump in weekly mobile app revenue, translating to an annualized $55M, or a 13% pop compared to its TTM. Whilst this sounds really positive, a quick look at the est. revenue chart shows that their mobile revenue has high variation due to live operations, and this looks like multiple apps having successful end of year updates vs their competitors.

In particular, "ヘブンバーンズレッド" (Heaven Burns Red) and "アナザーエデン 時空を超える猫" (Another Eden: The Cat Beyond Time and Space) are leading this charge, with respective revenue boosts of $673K and $192K.

Not a catalyst yet.

Loosers this week

No relevant companies in that bucket.

Ongoing Picks - Watch list

Drecom (3793.T)’s Wizardy Variants Daphne game surged the week prior, and this leads to this 60% increase we’re seeing on the dash. However, as the graph will show, this was rather short-lived. In any case, this suggests a successful run of their live operations for this game, and we remain bullish with regard to the ongoing quarter.

Gravity (GRVY), Gala Technology (2458.HK), Feiyu (1022.HK), Qingci (6633.HK): Nothing to see. All stable.