Mobile revenue roundup - Final week of 2024

Great time for the apps linked to hardware with christmas gifting in full swing. Drecom is our highlight this week.

We maintain a complete database of all publicly traded companies that are active in mobile marketplaces, and estimate their mobile revenue on a daily basis using proprietary tools.

This dash looks at trends in weekly revenue, and is one of multiple used for triage towards researching companies.

Public companies Dashboard - Highlights

Here is the dash, remarks below:

Reminder: The “Est. Rev Delta“ % is an increase/decreased from last week’s estimated mobile revenue versus the average of the past 7 weeks of mobile revenue.

Intro

With christmas offers in full swing, last week was expectedly quite unusual for a lot of app publishers. Think of all the device companies and their app subscriptions like GoPro (GPRO), or Arlo Technologies (ARLO, security cameras), which see a surge in device sales + special annual offers on their apps, leading them to surge up the grossing rank ladder.

Content

Winners

Loosers

Our Picks and Watchlist

Winners this week

US-traded

GoPro, Inc. (GPRO) is seeing an estimated 100% increase in weekly mobile app revenue, adding about $600K to their tally.. The *GoPro Quik* app is the main driver, with its revenue doubling from the previous week. Kept this one in just to show how this happens every year at the same time, see the revenue estimates in red below.

There’s something to be said about GoPro's growth in terms of their software subscription model, as they keep transitioning from a pure device play towards a hardware + software subscription company. But this is not the catalyst you are looking for!

Tapinator (TAPM) has tiny revenue that is very variable, no catalyst there either.

Worldwide Markets

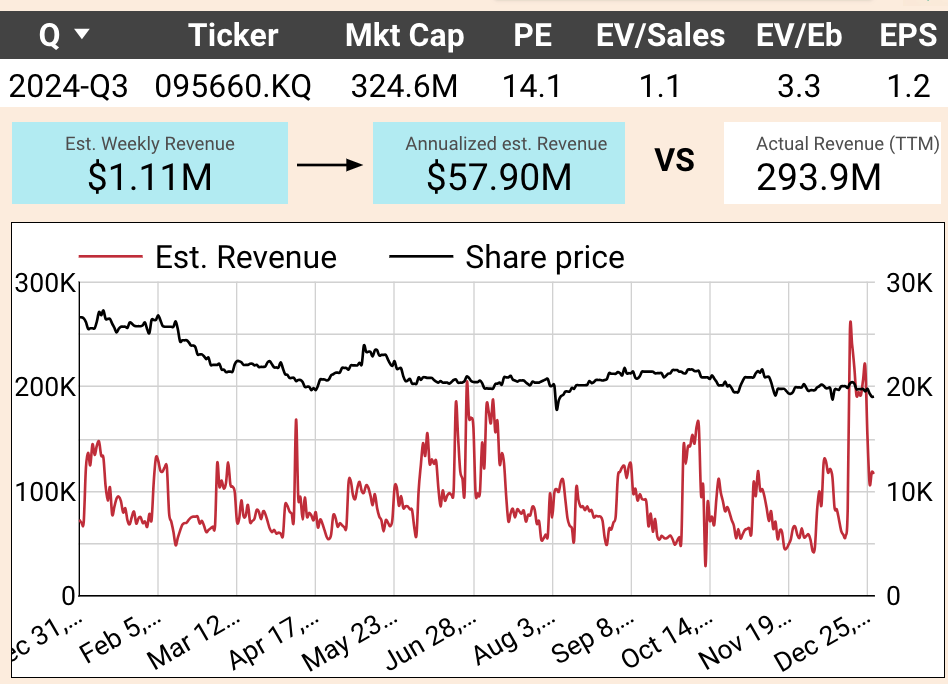

NEOWIZ (095660.KQ) remains top spot with an estimated 100% rise in weekly mobile app revenue, or about $550K, potentially spurring a 10% annualized boost against its TTM revenue. Again that revenue increase is driven by

BrownDust2 - Adventure RPG, with a 290% increase,

피망 쇼다운 홀덤* [Showdown Hold'em], launched 23 days ago, also upped its game by 182%.

As can be seen from the below graph, it’s a rather significant increase compared to its standard deviation, hinting at a potential valuation catalyst. Historically, NEOWIZ's weekly revenues fluctuated, yet this spike is notable.

Revenue has sharply dropped in the last week. Company has an EV/EBITDA of 3.3 and a PE of 14.1.

MAG Interactive (MAGI.ST) remain at the top, with their revenue increasing some more. This surge, if sustained, could serve as a valuation catalyst, given it represents about 7% of their TTM revenue. "QuizDuel! Trivia & Quiz game," launched just 19 days ago, significantly contributed with an estimated $41K increase, marking a 360% rise.

Over recent weeks, MAG Interactive has generally shown a consistent, albeit modest, upward trend, peaking this week. Additionally, with a low EV/Sales ratio of 0.6, the company might appear undervalued, but this is too small when compared to actual TTM revenue to be a real catalyst.

Loosers this week

No relevant companies in that bucket.

Ongoing Picks - Watch list

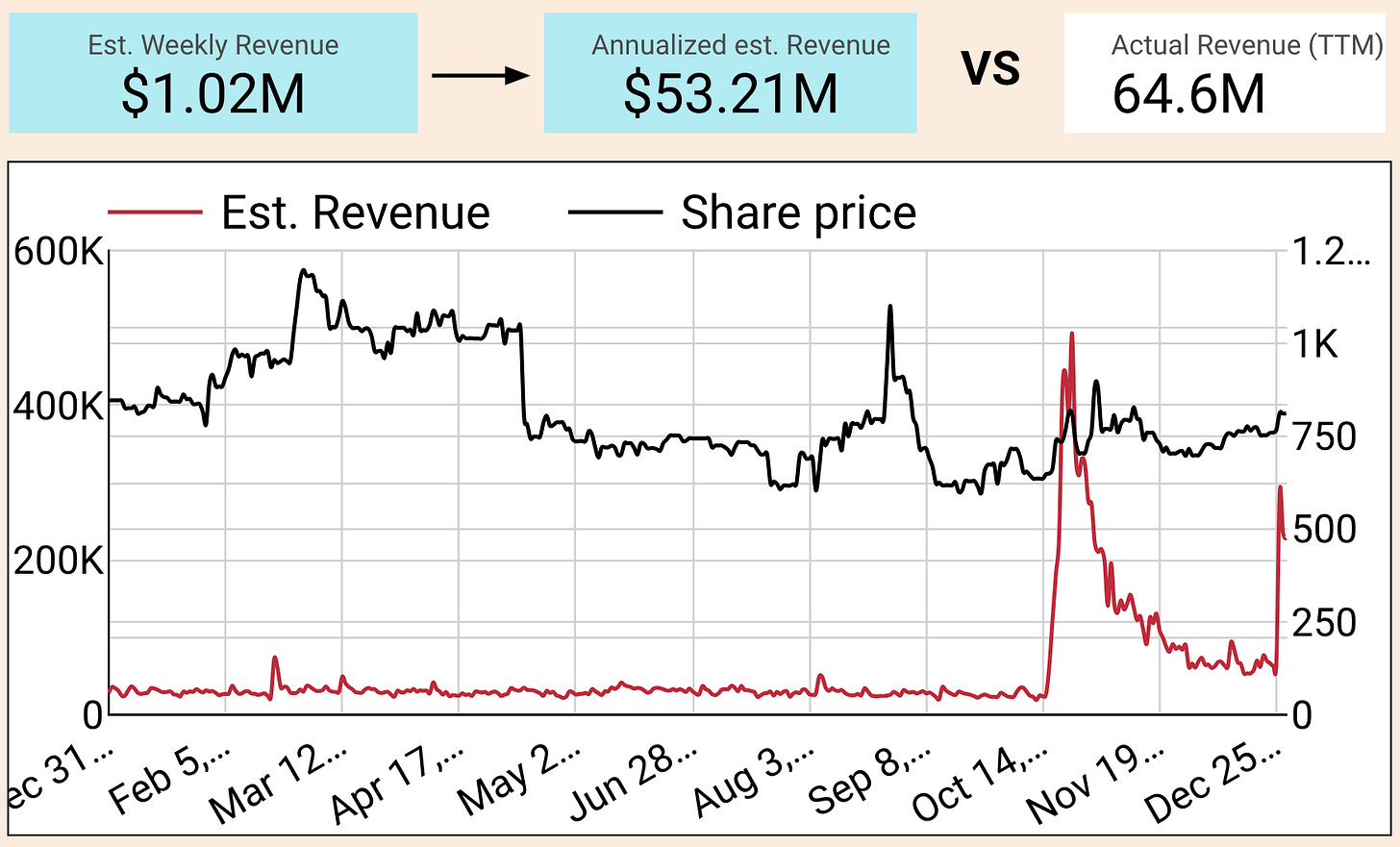

Drecom (3793.T) has seen a surge in revenue in the last few days only, entirely driven by their Wizardry game (Daphne). It’s been 3 months since its released and it is now seeing a resurgence it appears. That is extremely bullish for the long-term prospects of this game and the odds of Drecom moving towards profitability. As a reminder, they purchased the Wizardry IP a while back, and this is a first step in rejuvenating it!

Live Ops is the name of the game for them now.

Gravity (GRVY), Gala Technology (2458.HK), Feiyu (1022.HK), Qingci (6633.HK): Nothing to see. All stable.