Gala Technology (2458.HK) with a 46% revenue increase HoH

Gala Technology, whom we called the "mobile EA Sports of Asia", just announced a roaring end to their FY24, as we highlighted them in the fall.

Executive Summary

We spotted Gala (2458.HK) last summer as it became clear their mobile games were performing better and better, using our app ranks data mining approach.

They just announced a really strong FY24, in particular a very strong second half with revenue increase of 46% and more than doubling its net profits to $US 8 millions.

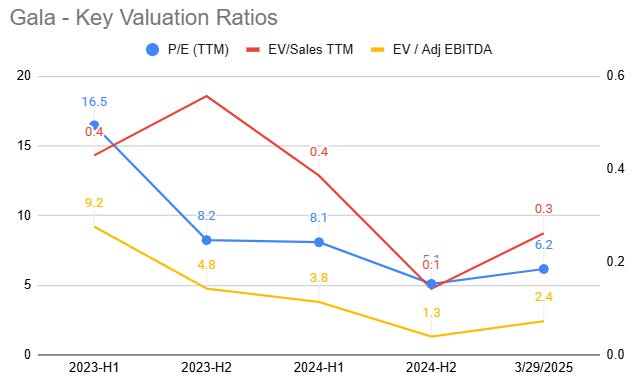

Cash-rich and debt-free, Gala has a very attractive valuation with

PE of 6

EV/Sales of 0.3x

EV/EBITDA of 2.4x.

Memory Lane - How we got into Gala

Catalyst

We started flagging Gala last summer when it became clear their revenue was increasing, not just through new releases like Clutch Hit Baseball but also through increases in existing games, one of the strongest proof of quality we can see in the mobile game space.

Here’s a chart of our daily estimated daily revenue for Gala from 2023-2024. You can easily see how the baseline moved up significantly last summer.

We purchased shares of Gala in December 2024 at a stock value of HKD 3.7/share, expecting that their H2 2024 was going to be clutch, pun intended.

Valuation

Let’s consider its valuation today at HKD4.05 a share.

With virtually no debt, $50M in cash and a market cap today of about $70M, Gala is right now valued at $28M millions (Enterprise Value, not discounted).

Even considering trailing twelve months value (which does not reflect future growth):

TTM revenue of > $100M means an EV/Sales ratio of 0.3x

TTM net profits of $12M giving it a EV/EBITDA ratio of 2.4x

PE of 6.

This valuation does not reflect the success and profitability of Gala in our opinion. It’s also worth noting that Gala has paid dividends in the past and has 57% insider ownership, which aligns their interest with their shareholders.

Gala Sports annual review - summary

Here is a summary of Gala Technology’s annual review document:

Core & New Game Performance

Football Champion maintained stable user and revenue growth through content refinements.

Total Football experienced significant growth, improving its market position.

NBA Rivals launched in 2024, topping Apple's App Store in China and gaining global attention, including a feature at Apple’s product launch.

Clutch Hit Baseball saw 20x revenue growth and over 2 million new users.

Expansion into Asian markets contributed to user base growth.

Financial Performance & R&D Investment

Total revenue reached RMB 776 million, a 22.61% increase over 2023

Second half of 2024 reached RMB 461.54 - a 46% increase vs H1, proving once again our methodology to identify revenue increase works!

Gross profit grew by 20.7% to RMB 416 million.

Net profit rose 13.3% to RMB 84.15 million.

R&D investment increased by 22.4% to RMB 133.7 million, focusing on game experience enhancements.

AI & AIGC Technology Advancements

2024 was a year of major tech advancements and Gala invested in integrating AI into their product development at every level

AI-driven Arena4D improved character movement realism

AI and physics optimization enhanced in-game action generation.

2025 Outlook & Expansion Plans

NBA Rivals to launch in Hong Kong, Macau, and Taiwan.

Football Champion Mini-Game Version 1.0 set for 2025 release.

Collaboration with MLB rising star Bobby Witt Jr. as Clutch Hit Baseball's global ambassador.

New game "Code: Fishing Master" to enter external testing in Q2 2025.

Commitment to Globalization & Innovation

Focus on localization of games for different regions.

Continued branding efforts and strategic partnerships (FIFPro, NBA, NBPA, MLB).

Long-term goal to refine gameplay and expand market presence globally.

Conclusion

Gala Technology’s annual review is likely to have outperformed investors expectations in our opinion. We expect to see the stock get some appreciation next week, but we also are aware that it is a thinly traded, small cap in Hong Kong, and therefore it may take a while until the market notices.

All in all, it’s a profitable company with a strong balance sheet trading at really low multiples, with interesting growth prospects.

This makes it a long-term hold for us at these levels.

Up 10% today on earnings!