Feiyu is doing well, its stock isn’t. Why we averaged down.

We initiated Feiyu in May 2022 following the successful release of Dougui, which was shortly followed by Carrot Fantasy 4. The stock doesn't reflect Feiyu's return to profitability.

Executive Summary

Feiyu’s return to profitability has been missed by investors and the stock has been batted in the past 6 months, going from HKD 0.34 to HKD 0.20

With Carrot Fantasy 4 still performing and the launch of Shen Xian Dao (got to top 11 grossing in China), H2 2023 will be profitable again. We expect them to post a positive profit alert soon.

Feiyu will boast a PE of 4 upon their upcomingearnings release, an all-time low for this company.

Feiyu is a Chinese, small cap, with low traded volume, all of which adds a lot of risk to the table. We size our position accordingly

With its valuation back to levels to when it was quite unprofitable, we see an opportunity.

We decided to average down our position, and we explain why here. Let’s dig in!

Feiyu’s datasheet is available here (couple updates to come soon).

Feiyu’s profitable turnaround

H1 2023 earnings reminder

In the first half of 2023,, Feiyu announced a 45% YoY revenue increase and a return to profitability with RMB 40.3M, or US$ 5.7M, in net income. We fully expected as we are monitoring their mobile game performance, which covers 85% of their total revenue.

This increase is primarily due to the continued success of Carrot Fantasy 4, as well as the launch of Shen Xian Dao 3 on June 7th 2023.

Onto the second half of 2023 now!

Operations in H2 2023

Beyond mobile gaming revenue (in app purchases), Feiyu’s other source of income includes advertising revenue (10% of total), licensing/IP-related income as well selling their game development as a service.

So let’s focus on the mobile game operations, shall we?

Carrot Fantasy 4

Their biggest long-tail success in the legacy games is Carrot Fantasy 4 (or 保卫萝卜4 in chinese). Mainland China players can’t seem to have enough of it after its initial release in June 2022, the game is at cruising speed and has been steadily maintaining its top grossing around the 200-300 marks throughout H2 2023. We estimate its total revenue at about $4-$6M for the half year. Feiyu has done a good job of prioritizing long-term revenue on this one, releasing new activities and content on an ongoing basis.

New launch: Shen Xian Dao 3

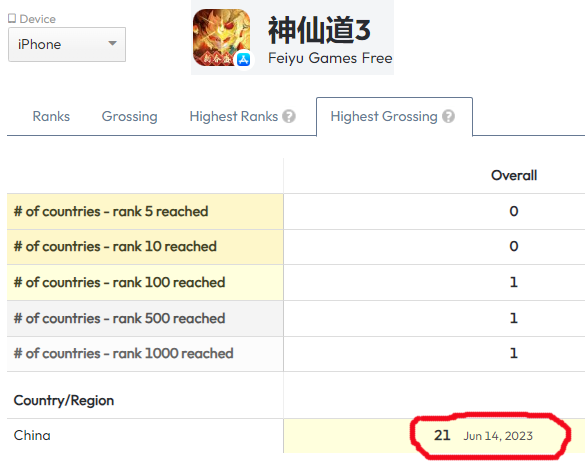

Published by Nuverse, the game division of ByteDance, the company behind TikTok, Shen Xian Dao 3 is a card game developed by Feiyu. The game hit top 20 in top grossing in China upon its release in June 2023 which is huge. However, as it’s often the case in China, the success was relatively short-lived. 6 months in, the game has stabilized in the top 300-400 on a daily basis on Apple App Stores.

All in all, if we extrapolate Android revenue based on Apple revenue (Play store is not available in China), our models show that it probably generated $4 to $6M in June 2023, and $5-$7M in the second half of 2023. The game is probably generating around $300-$500K a month today and we expect that tail to slowly dwindle at a pace of 5-10% a month. How much does Feiyu make from that is a hard guess, but we’ll go with a 50%/50% split as an initial assumption, so $2.5-3.5M in H2 2023 from Shen Xian Dao 3.

As Nuverse is shutting down most of its operations, we expect Feiyu to take over the publishing of the game in the future, or find another partnership. We could not find any news related to that, but then again, we do not speak chinese, so there’s that.

Other games

Other legacy games have not significantly moved the needle in H2 2023. Dougui, which was released in Spring 2022, has seen its revenues slowly dwindle. Still generating around $2M in H1 2023, we think its contribution to H2 2023 is in the $500K range, so not meaningful anymore.

Here is our chart estimating Feiyu’s mobile game revenue (in green) and comparing to its stock.- You clearly see the May 2022 Dougui release where we bought, and the stock shot up but then slowly dwindled again.

Looking into the future and conclusion on H2 2023 Operations

Feiyu’s pipeline is not shared in their reports. They mentioned their plan to introduce Dougui and Shen Xian Dao 3 overseas, which likely means Hong Kong and Taiwan, in the near future, which is of course positive. These markets tend to do well for games that have done well in China, and vice-versa.

H2 2023 (our estimates)

In conclusion, H2 2023 looks like it’ll be profitable, albeit with lower revenue than H1 but higher profit margin, given the main release this year was in June 2023 and likely part of H1 advertising costs.

What does that mean in terms of valuation? That’s next!

Stock, Valuation & Balance Sheet

Stock: Has been continuously battered, more than halving in the last 12 months, no less, since the March 2023 high of HK$0.46. As of February 5th, the stock is at HKD $0.21.

In terms of valuation now. Using mid range of our H2 2023 estimatesand the current price of HKD 0.21, we estimate the following current valuation metrics:

PE of 4.5, following the past 12 months of profits, assuming an EPS of $0.006

EV/Sales estimated at 1.4x which remains on the lower side of the gaming market (see graph comparing with a few competitors)

I could not find EBITDA metrics, so using net income: EV/Net Income sits at a meager 4.0, one of the lowest we’ve seen. No it’s not Gravity’s, but they’re not holding on to a cash chest either, so there’s that!

* Note: Feiyu and Qingci valuation are based on our estimates of their H2 earnings that are coming up soon.

Balance sheet: Approx. US$ 19M in cash vs US$ 14.5 M in debt as of H1’2023. It’s clear that if they are able to keep milking Carrot Fantasy 4 (or the next iteration of it) as they are doing for over a year and a half now, their balance sheet will keep strengthening and we do not expect any dilution coming our way.

Pros & Cons

What we like

Back to profitability, much improved operations and net profit margins (37% in H1 2023), yet the stock has not yet appreciated the slightest. It used to command much higher valuation.

Both Dougui and Shen Xian Dao 3 releases were quite spectacular, and we expect the games will do well in Hong Kong and Taiwan too.

Tencent holds 15% of the shares of the company, with overall 60% insider ownership, whose interests are therefore close to shareholders. Dividend soon?

What we don’t like

China…

We’re always cautious in investing in a country in which a government can influence an industry so drastically on an industry. We consider this greatly when sizing our position

The broader investment sentiment is grim, already triggering a sell-off in equities in the past months. It could take a while to recover..

They did not manage to maintain their successful released games in the top 50 or top 100 for long, but rather in the top 200/300 so far.

Not unlike Qingci, the stock is extremely thinly traded with absolutely no coverage from analysts, so it’s not easy to build a decent position.

Conclusion

With the stock tumbling down, the risk reward was just too good, we were compelled to scoop a few more shares in the past few days. It remains a risky play given how small the company is in a big chinese market.

We are eager for investors to wake up to this turnaround of the company which make take some time as the company is not covered by analysts. But its return to profitability seems here to stay and we expect they will announce a profit alert after the lunar new year, next week.

Disclaimer

The information on this website and blog is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.

Feiyu (HK:1022) just posted a positive profit alert, as expected and mentioned in this latest article. 2023 will come out at RMB 50-65M in net profit, so $US 7-9, after tax. That compares to a loss of approx. US$3.5M in 2022.

It's slightly lower that we estimated, but still makes H2 another profitable quarter. That'll give them a PE of 5 as it sits in all-time low valuation, even after its profitability turnaround (since H1 2023).